Abstract

When a crypto person takes sole possession of their pockets’s non-public keys as an alternative of trusting them to an trade, they’re self-custodying their property. Safety aware crypto customers usually choose self-custody as a result of they will keep whole management over their funds, requiring no third-party involvement. Leveraging a self-custody pockets requires a little bit of technical know-how and belief in your self, as you’ll be your individual banker in addition to head of safety. The method of self-custodying your crypto property entails discovering a dependable self-custody pockets supplier then transfering your funds from a centralized trade to this new pockets. A very powerful side of self-custody is safety! It’s as much as you to safe your restoration phrases and different delicate crypto data to maintain your funds secure.

Traditionally, crypto customers have been divided into distinct camps: those that want to safe their very own funds through the use of a self-custody pockets (also called a self-custodial pockets), and people who choose to entrust safety to a third-party pockets or trade. If latest occasions have you ever rethinking your custody technique, and even occupied with it for the primary time, learn on for a primer on tips on how to make the transfer to self-custody your property.

On this article

What’s a self-custody pockets?

Crypto wallets could share a reputation with the leather-based billfold you retain in your again pocket, however the similarities finish there. In contrast to analog wallets, crypto wallets don’t truly comprise your crypto funds. Moderately, crypto wallets safe your non-public keys, that are required to entry your funds on the blockchain.

Crypto exchanges reminiscent of Coinbase or Kraken present custodial wallets, that means they’re answerable for safeguarding your keys. Anytime you provoke a crypto transaction on an trade, they digitally “signal” it utilizing your non-public key from throughout the pockets. All of it occurs seemingly mechanically, with little to no person intervention required. Many customers choose custodial wallets as a result of they’d reasonably not trouble with safety themselves. Nonetheless to others, trusting management of their non-public keys to a third-party is totally unthinkable.

For these extra security-minded customers, solely a self-custody crypto pockets will do. When self-custodying your crypto property, no third-party could have entry to your pockets’s non-public keys. Not even the pockets supplier. Self-custodying requires a larger diploma of technical know-how than exchange-provided custodial wallets, so there could also be a slight studying curve concerned. Self-custody wallets enable customers to function their very own banker, however the trade-off is that pockets safety additionally turns into their sole duty. A misplaced account password at a crypto trade can seemingly be recovered. Nonetheless if you happen to’re self-custodying and misplace your restoration phrase, your funds might be misplaced perpetually. That stated, there are safeguards in place to assist keep away from these circumstances.

The advantages of self-custody: whole management of your crypto

When referring to the age-old debate of custodial vs. non-custodial wallets, a typical chorus amongst crypto lovers is “not your keys, not your crypto”. Whoever controls a pockets’s non-public keys, whether or not it’s a person or a company, has unfettered entry to its corresponding property. Many customers consider that is core good thing about self-custody wallets: this implies until you’re self-custodying your non-public keys, you don’t truly “personal” your crypto.

The FTX collapse is a stark illustration of the potential safety risk custodial crypto wallets can carry, and a reminder of the very actual chance of shedding funds entrusted to a third-party. Some {industry} observers have even in contrast the FTX collapse to the chapter of Lehman Brothers, which kicked off the 2008 monetary disaster.

Custodial wallets have lengthy been tempting targets for hackers and different cybercriminals. Over time these dangerous actors have made off with billions of {dollars} value of ill-gotten crypto funds utilizing varied exploits. FTX is way from the primary custodial pockets supplier to allegedly lose or misuse person funds. Nonetheless, as one of many largest and most trusted exchanges, the information of its fall from grace has rattled the crypto {industry}, and propelled self-custody to a front-of-mind subject.

The way to self-custody bitcoin & different cryptocurrency

In an effort to self-custody your bitcoin, you should first create a self-custody pockets. Whether or not you are simply starting to construct your crypto portfolio or are transferring a steadiness from a custodial trade pockets, this is the method of making a self-custody pockets will look.

- Select your pockets kind: Resolve if you would like to make use of a software program pockets or laborious pockets.

- Select your pockets supplier: BitPay’s self-custody pockets app is on the market for all working programs and supplies self-custody advantages for novices and professionals alike. Obtain the app to get began.

- Create a brand new pockets/key: As soon as you’ve got chosen your most well-liked pockets supplier, generate a non-public key. Relying in your present portfolio, storage preferences, or pockets supplier, chances are you’ll select to create a couple of non-public key.

- Again up your pockets: In contrast to custodial providers, self-custody pockets suppliers don’t management your non-public keys. Whereas self-custody wallets empower you with the instruments to maintain your funds safe, will probably be your duty to again up and safe entry to your pockets. One of the simplest ways to do that is by backing up your 12 phrase restoration phrase.

- Switch, purchase or obtain crypto in your new self-custody pockets: Now that your pockets is created, its time to fill it with crypto! Should you plan to switch present funds from an trade pockets or are receiving from one other self-custody pockets, be sure that funds are despatched to the right tackle. If transferring/receiving massive quantities, ship a smaller check quantity to be completely positive you’ve got bought the tackle right. Cryptocurrency transactions are irreversible and crypto addresses aren’t interoperable – BTC can solely be despatched to a Bitcoin pockets tackle, ETH can solely be despatched to an Ethereum pockets tackle. If a cryptocurrency is shipped to the incorrect tackle then there’s a good likelihood that you’ll be unable to recuperate your funds!

In case you are beginning your portfolio from scratch, make the most of BitPay’s cryptocurrency market to seamlessly purchase crypto at the most effective charges with no hidden charges.

What can I do with a self-custody pockets?

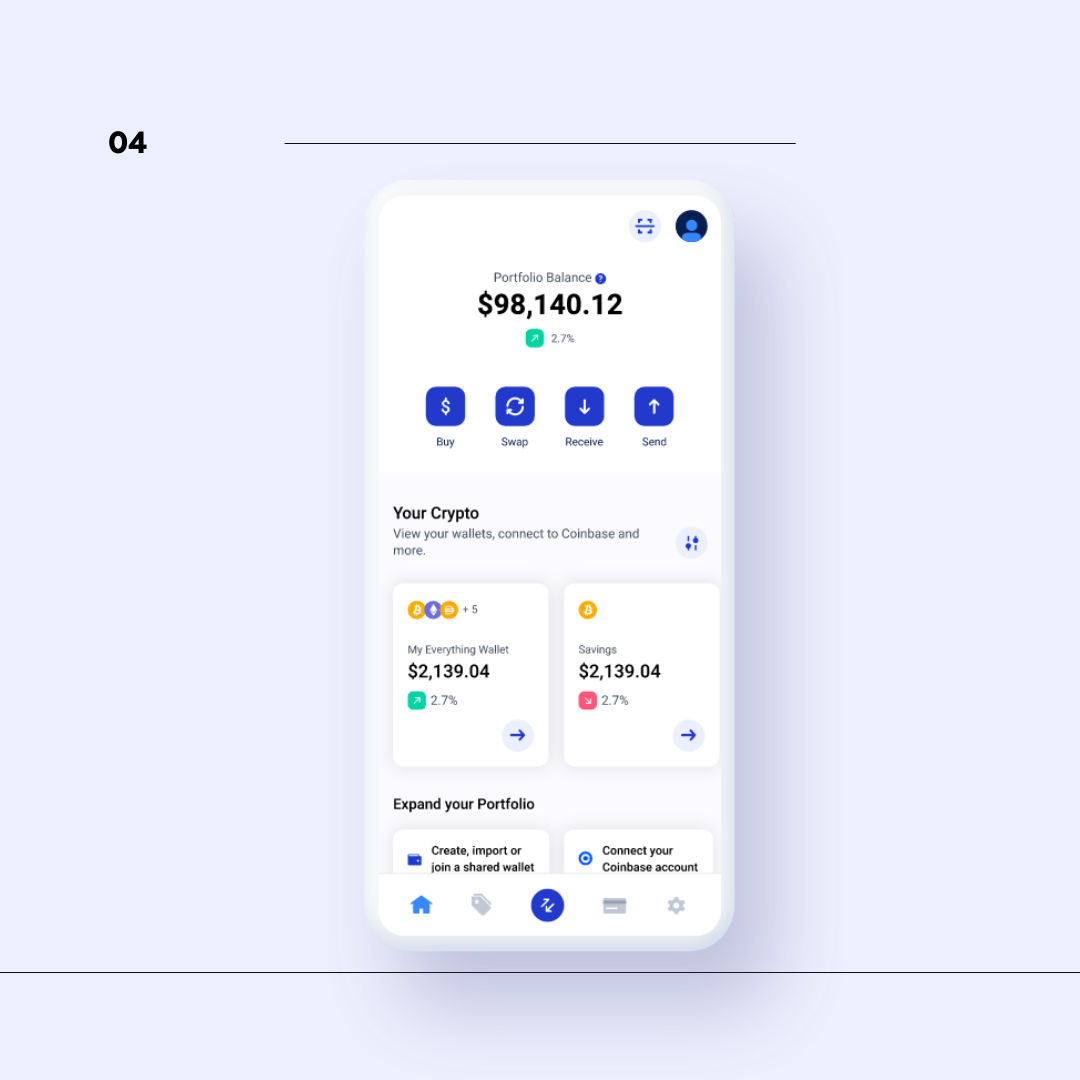

BitPay gives an {industry} main self-custody crypto pockets answer that provides customers whole management over their funds. You should purchase, swap, retailer, ship, obtain and make crypto funds the way you need, while you need. Your non-public keys won’t ever go away your possession, so that you’ll by no means must query who has your keys and what they’re doing with them.

Retailer securely

By no means belief one other web site to safeguard your crypto funds. As a substitute, safe your crypto with a self-custody pockets. The BitPay Pockets supplies simple backups and industry-leading safety, permitting you to simply handle a number of wallets, platforms or copayers proper from the app. Plus, as a multichain pockets, you need to use it as a self-custody bitcoin pockets and handle tokens throughout a number of blockchains multi functional place.

Purchase

Discover aggressive costs on the preferred cryptocurrencies and stablecoins, together with Bitcoin, Ethereum, Litecoin, Dogecoin, Bitcoin Money and extra. BitPay enables you to purchase crypto with a bank card, debit card, Apple Pay or Google Pay offering near-instant supply with no extreme markups or charges.

Swap

Need to trade one coin for an additional? Simply and securely swap your crypto from throughout the BitPay app. Merely faucet the “Swap” button from the homescreen, choose the property you want to swap and the quantities, and obtain aggressive quotes in seconds. Learn our full information on swapping crypto with BitPay.

Switch/Ship/Obtain

Transfer, ship or obtain safe crypto to any pockets all over the world. Even seamlessly switch your crypto throughout totally different wallets and gadgets by exporting/importing your pockets keys.

Pay with Crypto

Self-custody wallets make the method of paying with crypto easy and safe with a number of methods to spend your crypto. Ship crypto straight to a different person’s pockets. Purchase present playing cards with crypto. Load a crypto debit card. Or, store with retailers that settle for crypto funds. BitPay’s crypto cost stats present that self-custody wallets just like the BitPay Pockets have greater cost success charges than trade wallets like Kraken or Coinbase, leading to a smoother expertise while you transact with crypto.

Take management of your crypto

Get the BitPay Self-Custody Pockets

I at the moment use a custodial service – how do I self-custody my crypto?

Transferring your crypto out of your custodial account to a brand new self-custody pockets is a comparatively simple course of. Most self-custody wallets are free and might be arrange in minutes. Right here’s tips on how to self-custody your crypto.

Step 1: Create a self-custody pockets

Obtain BitPay Pockets free of charge. It is obtainable on cell, pill and desktop gadgets throughout Android, iOS, Mac, Home windows and Linux working programs. After getting the app, create a key together with a pockets for every cryptocurrency you want to retailer.

Step 2: Report your new pockets tackle (or addresses)

You’ll must know your pockets’s tackle. Within the BitPay Pockets app, you could find this by choosing “My Key” on the house display, tapping into your pockets, tapping the three dots within the higher proper nook, and eventually choosing “Share Tackle”. From right here you’ll be able to write down your pockets tackle or copy it to your clipboard for the following steps.

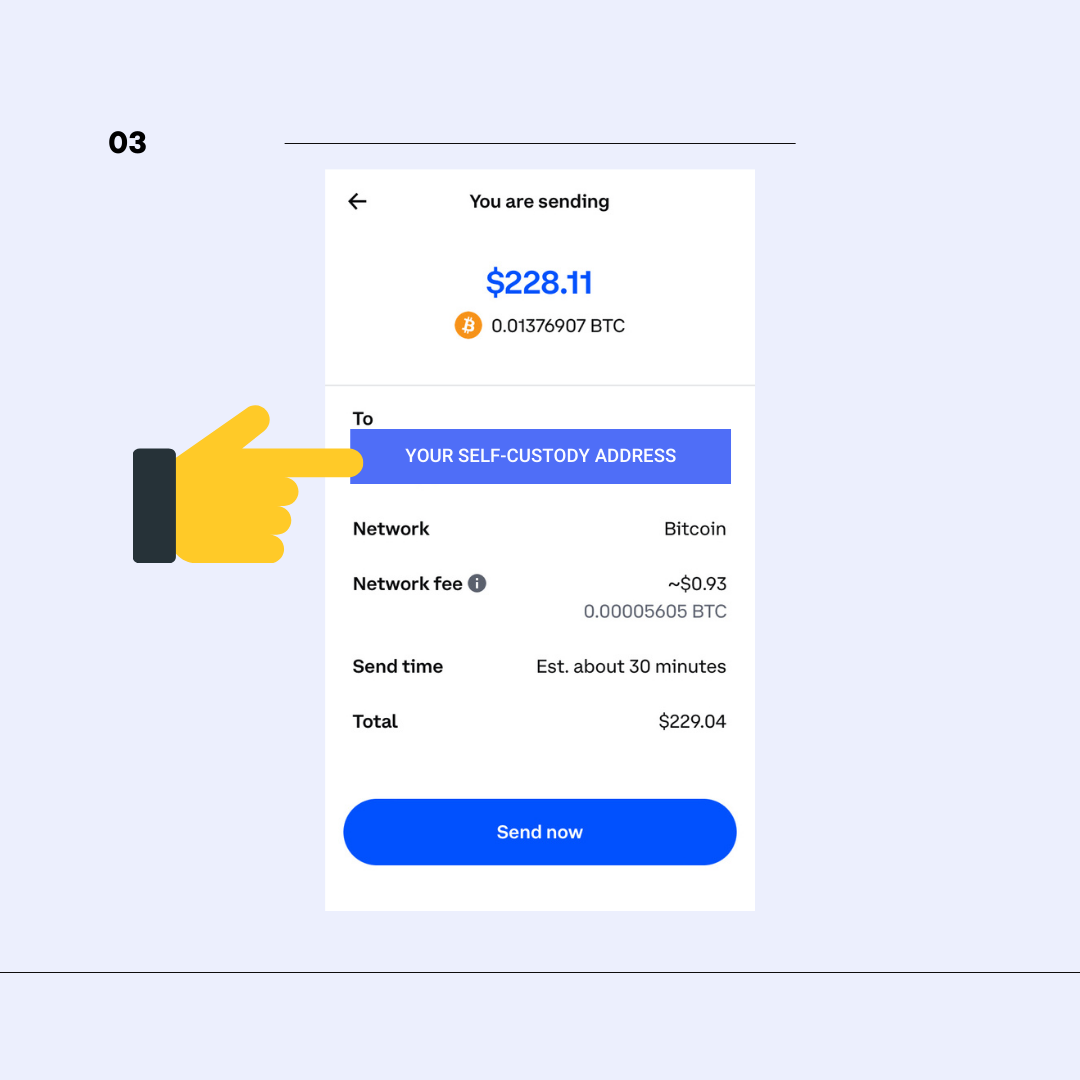

Step 3: Provoke the switch out of your custodial account

Generally, transferring property from a custodial service like Coinbase to a self-custody pockets like BitPay is so simple as sending crypto from one tackle to a different. Along with your new self-custody pockets addresses readily available, log into your custodial account. Choose the Ship possibility in your custodial account. Choose the asset you’d prefer to switch. Enter in your new self-custody tackle (the one we simply created a number of steps in the past). Now enter the quantity of cryptocurrency you’d prefer to switch. Evaluate the transaction particulars and make sure to ship the cost.

These steps could range relying in your custodial service. Evaluate the steps for widespread custodial providers under.

Self-Custody Tip: It’s at all times a good suggestion to ship a small quantity of crypto earlier than transferring massive quantities to a brand new pockets to be sure to have the right tackle. Bear in mind: as soon as a transaction is made, it might probably’t be reversed

Step 4: Take pleasure in the brand new management of a self-custody pockets

As soon as the transaction is full, you’ll see your transferred crypto within the “My Key” part of the BitPay app. Whereas self-custody signifies that there isn’t a third social gathering in between you and your crypto, it is best to nonetheless train excessive warning to hold your crypto secure, particularly on the subject of your pockets’s restoration phrase. In an effort to shield your funds from being accessible to hackers and thieves, retailer your restoration phrase in a secure and safe place.

Do I nonetheless want to purchase crypto on an trade with a self-custody pockets?

Most self-custody providers facilitate crypto transactions from throughout the pockets. BitPay gives aggressive charges on the highest cryptocurrencies with versatile cost strategies. All bought crypto is delivered shortly and saved in your new self-custody pockets.