A whale has been noticed aggressively accumulating LINK, the native token of the decentralized oracle community Chainlink, in response to blockchain monitoring agency Lookonchain.

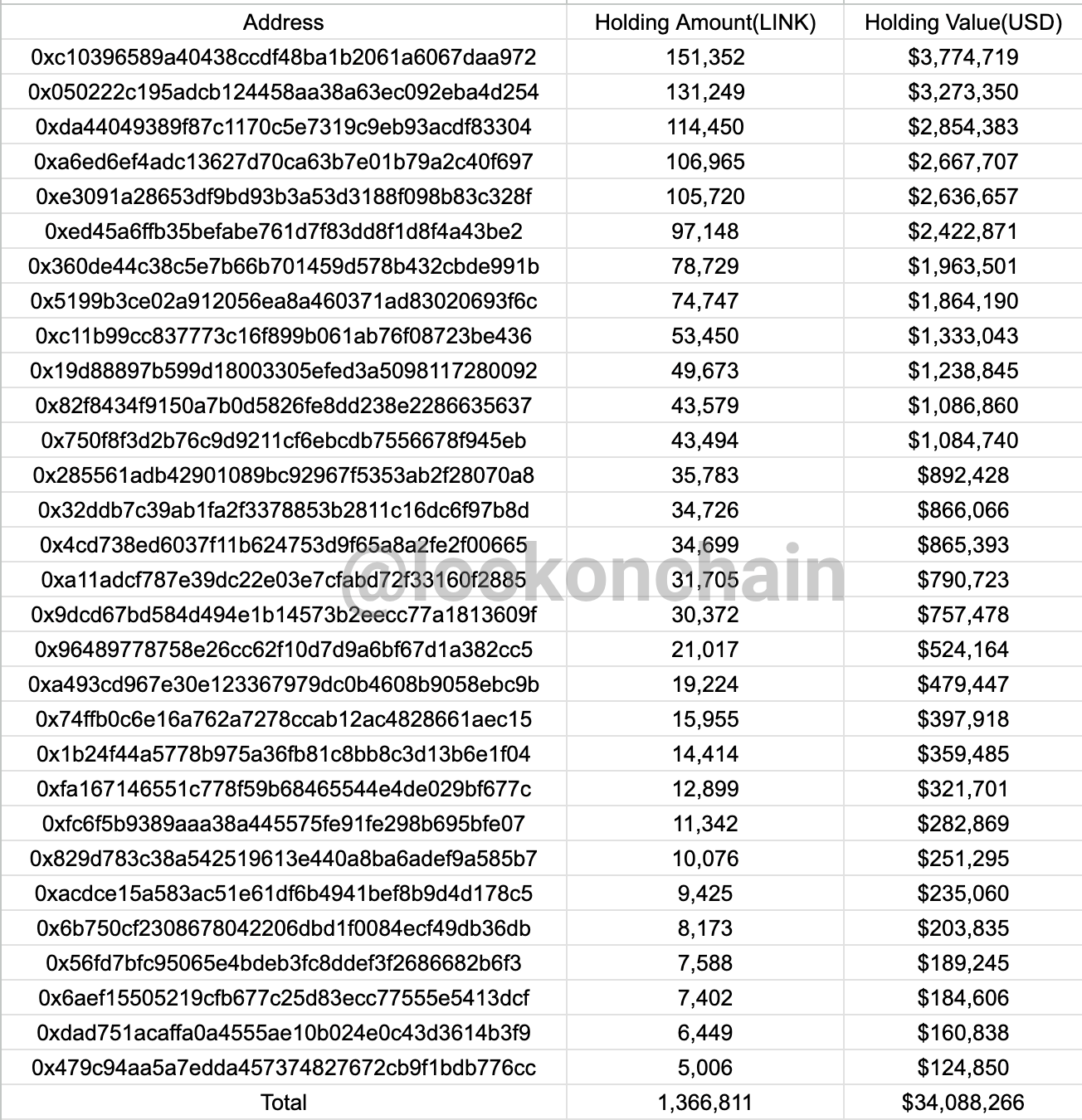

Lookonchain experiences {that a} whale all of the sudden created 30 new wallets to build up $34.1 million value of LINK tokens from Binance.

“Suspicious LINK accumulation noticed!

Over the previous 5 days, 30 newly created wallets have withdrawn 1.37M LINK ($34.1M) from Binance.”

At time of writing, Chainlink is buying and selling at $24.04, up 34% within the final month.

Earlier this week, Chainlink launched Sensible Worth Recapture (SVR), an answer aiming to permit DeFi options to recapture non-toxic Maximal Extractable Worth (MEV) from the main oracle’s value feeds.

“Based mostly on real-world testing, we consider Chainlink SVR can anticipate to attain a practical worth recapture fee of roughly 40% (i.e., for each $100 that may have been leaked through liquidation MEV, $40 was recaptured). Whereas some various options have claimed to attain a better effectivity fee for recapturing liquidation MEV, we’ve not seen conclusive real-world knowledge to showcase this. We consider that 40% is a conservative however practical estimate—actual life efficiency can be wanted to assemble precise knowledge.”

On the identical day because the announcement from Chainlink, Aave, the largest lending platform in crypto, proposed utilizing SVR.

Particularly, the proposal was about activating a pilot program of SVR oracles on Aave v3 to recapture MEV from the platform’s liquidations to return its personal ecosystem. The proposal is at present awaiting questions and suggestions from the group.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Examine Value Motion

Comply with us on X, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any losses you could incur are your accountability. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please notice that The Every day Hodl participates in online marketing.

Featured Picture: Shutterstock/GrandeDuc