The crypto market has hit a brand new milestone as BlackRock’s spot Ethereum ETF surpassed $1 billion in worth for the primary time.

Latest information from SoSoValue reveals that after six weeks of steady detrimental outflows, US spot Ethereum ETFs have reversed the pattern. They recorded their highest weekly inflows since early August. On Friday, these funds drew $58.7 million, contributing to a complete weekly influx of $84.5 million.

Constancy’s FETH fund led this resurgence, pulling in $42.5 million on Friday. Nonetheless, BlackRock’s ETHA fund stood out, attracting $11.5 million and surpassing the $1 billion mark in complete property simply two months after its launch. This locations BlackRock’s fund in a distinguished place alongside Grayscale’s Ethereum Mini Belief, one of many few which have reached such a valuation.

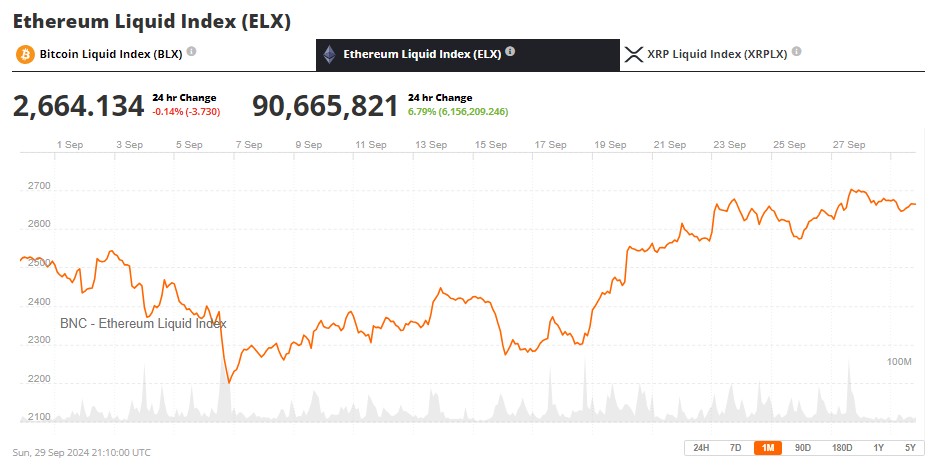

The Ethereum worth has been trending steadily upwards since early September. Supply: Courageous New Coin’s Ethereum Liquid Index (ELX).

This accomplishment holds appreciable significance. As Nate Geraci, president of The ETF Retailer, factors out, BlackRock’s fund now ranks among the many prime 20% of over 3,700 ETFs within the US market. This fast rise highlights the growing demand for cryptocurrency investments from each institutional and particular person buyers.

Ethereum ETFs Acquire Momentum as Market Sentiment Shifts

The constructive pattern wasn’t restricted to BlackRock and Constancy. A number of different Ethereum ETFs additionally skilled notable inflows on Friday, together with Bitwise’s ETHW ($5.4 million), Invesco’s QETH ($4.3 million), Grayscale’s ETH ($2.3 million), VanEck’s ETHV ($2.0 million), and 21Shares’ CETH ($1.4 million). Whereas Franklin’s EZET maintained a impartial place with no web influx or outflow, Grayscale’s ETHE was the outlier, experiencing $10.7 million in outflows.

The resurgence in Ethereum ETFs is especially noteworthy given the broader context of the cryptocurrency market. The value of Ether has just lately outperformed Bitcoin, buoyed by renewed optimism amongst futures merchants following the Federal Reserve’s latest charge reduce. Moreover, transaction charges on the Ethereum community have surged, indicating a major uptick in blockchain exercise.

As of September twenty ninth, 2024, Ethereum’s worth stood at $2,647, with a market capitalization of $318.2 billion, based on Courageous New Coin’s Ethereum Liquid Index. Whereas this valuation is substantial, it nonetheless lags significantly behind Bitcoin’s $1.298 trillion market cap. Nonetheless, the latest developments within the ETF house, coupled with Ethereum’s transition to a Proof-of-Stake consensus mechanism and growing institutional adoption, recommend that the hole could also be narrowing.

Ethereum’s Potential to Problem Bitcoin’s Dominance

The latest surge in Ethereum ETF inflows has reignited discussions concerning the cryptocurrency’s potential to problem Bitcoin’s market dominance. If Ethereum had been to match Bitcoin’s present market capitalization of $1.298 trillion, it will translate to an Ether worth of roughly $10,785, based mostly on the present circulating provide of 120,366,230 ETH. This theoretical situation would signify a staggering 309% improve from its present buying and selling worth.

Whereas such a monumental shift could seem bold, a number of components are aligning in Ethereum’s favor. The community’s co-founder, Vitalik Buterin, just lately outlined a set of guiding rules geared toward making certain alignment throughout the Ethereum ecosystem. These proposals emphasize open-source growth, open requirements, and a prioritization of decentralization and safety. Buterin additionally confused the significance of collaboration and alignment towards Ethereum’s targets and the broader world blockchain group.

“My excellent objective right here is to see extra entities like L2beat rising to trace how properly particular person initiatives are assembly the above standards,” Buterin acknowledged in his weblog, underscoring the group’s dedication to transparency and accountability.

Ethereum Eyes Rebound Amid Market Volatility

Regardless of the latest constructive developments, it’s necessary to notice that the cryptocurrency market stays extremely risky. Since late Could 2024, Ether’s worth has undergone a notable correction, falling from $3,974 to $2,649 – a 33% decline. This bearish pattern has led some analysts to undertaking a possible additional drop of 18.7% earlier than the asset retests its main assist trendline, established on June 22.

Nonetheless, historic information means that such retracements usually precede important rallies. Prior to now, reversals from this dynamic assist stage have led to a doubling of the altcoin’s worth, indicating that present worth ranges might signify a key accumulation zone for long-term buyers.

The potential for Ethereum to match Bitcoin’s market cap is underpinned by its energetic growth within the decentralized finance (DeFi) ecosystem and growing institutional funding. The latest surge in ETF inflows serves as a testomony to rising confidence in Ethereum’s long-term prospects.