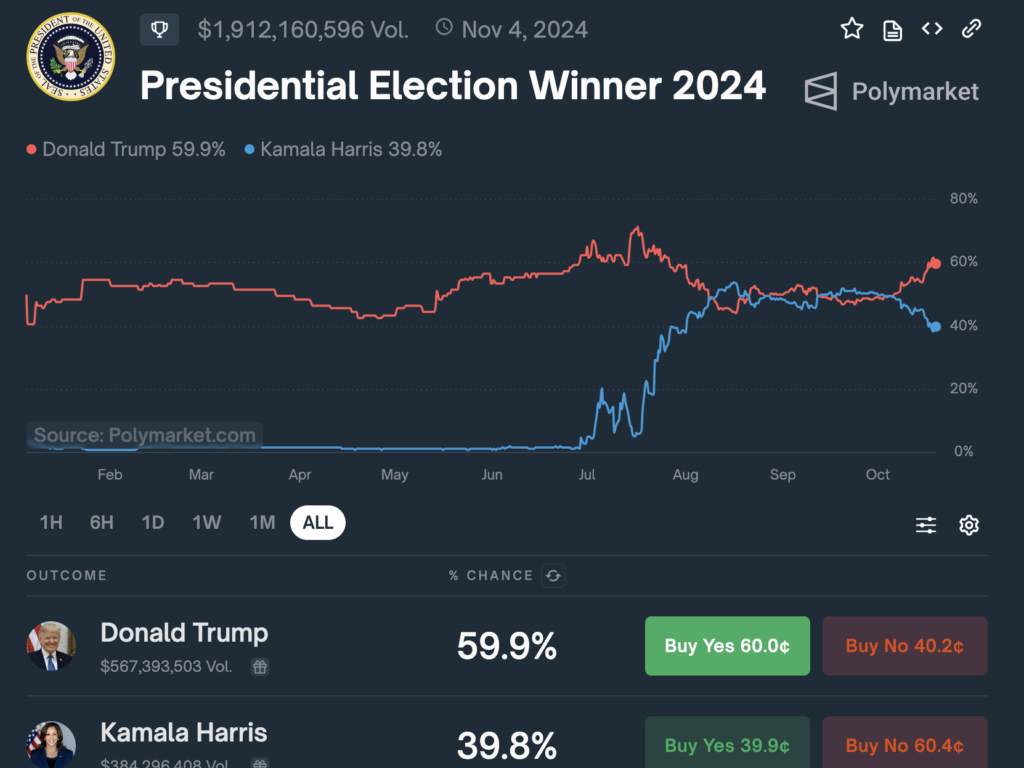

Former U.S. President Donald Trump’s odds of successful the 2024 U.S. presidential election have surged, hitting a two-month excessive, in line with main prediction market Polymarket. As of the most recent figures, Trump holds a 59.9% probability of victory, whereas Vice President Kamala Harris trails with 39.8%. These percentages mirror the feelings of merchants who’ve collectively wagered over $1.6 billion on the result of the November election.

Supply: Polymarket

Different prediction platforms, corresponding to Kalshi and PredictIt, additionally present Trump main. Kalshi, which not too long ago gained permission to record U.S. election contracts, places Trump at 52% in comparison with Harris’ 48%, whereas PredictIt exhibits a slimmer margin, with Trump at 53% and Harris at 52%.

The surge in Trump’s odds comes at a time when the cryptocurrency trade is keenly watching the election. Trump has promised to show the U.S. into the “crypto capital of the world,” and a few specialists consider that no matter who wins, cryptocurrencies corresponding to Bitcoin are poised for important development.

Crypto and Election Outlook

Based on Dan Tapiero, founding father of 10T Holdings, the worth of Bitcoin is anticipated to hit $100,000 quickly, no matter the election outcomes. Talking on the Permissionless convention in Salt Lake Metropolis, Utah, Tapiero remarked, “I don’t suppose it actually issues. Every thing goes up now. The election will move.” Tapiero believes Bitcoin is a proxy for the broader cryptocurrency market and expects different digital belongings to observe Bitcoin’s upward trajectory.

Equally, CK Zheng, Chief Funding Officer of ZX Squared Capital, additionally expressed optimism, saying that the upcoming election would profit Bitcoin whatever the winner. Zheng highlighted the upcoming Bitcoin halving occasion in April, which traditionally results in sturdy fourth quarters, as a significant driver of worth will increase. He added that neither Trump nor Harris has addressed rising U.S. money owed and deficits, a problem that would play in Bitcoin’s favor post-election. “This will likely be very bullish for Bitcoin, particularly publish the U.S. election,” Zheng famous.

Trump’s Crypto Attraction vs. Harris’ New Tech Focus

Trump’s pro-crypto stance has captured the eye of many within the trade. He has vowed to fireside SEC Chairman Gary Gensler, who has led aggressive enforcement actions towards cryptocurrency corporations. Gensler’s insurance policies have been seen as stifling innovation, and Trump’s promise to take away him has been met with applause by many crypto fanatics.

Nevertheless, Kamala Harris isn’t totally silent on the problem. In latest weeks, she has included blockchain expertise as one in all a number of rising applied sciences the place she believes the U.S. ought to stay dominant. This shift has been seen as a response to the rising significance of crypto and digital belongings in international markets.

Apparently, SEC enforcement head Gurbir Grewal stepped down in early October, probably signaling a pivot within the present administration’s strategy to crypto regulation.

Blended Reactions from Crypto Supporters

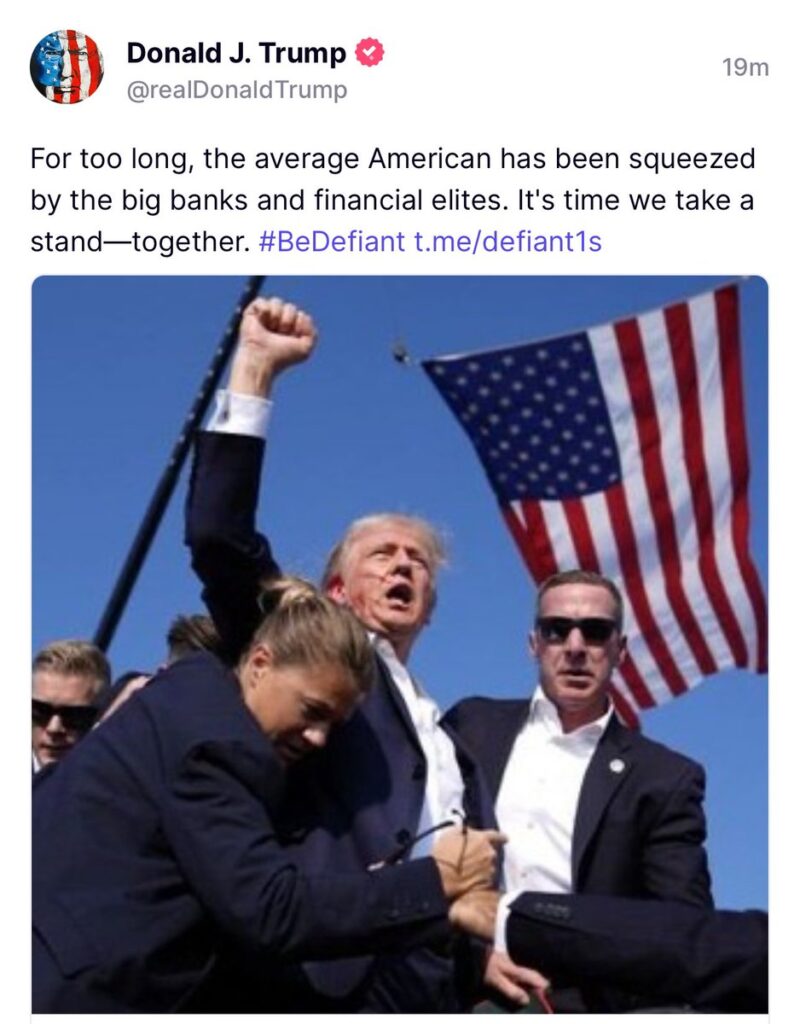

Regardless of Trump’s vocal help for cryptocurrencies, some within the crypto group stay divided. His controversial launch of a Trump-affiliated crypto undertaking in September led some trade supporters to criticize him, stating that he had “misplaced their votes.”

Supply: X

Nonetheless, crypto markets stay optimistic concerning the future. Monetary specialists, together with Alex Kruger, founding father of Asgard, consider that broader financial forces, corresponding to price cuts and elevated liquidity, will drive asset costs larger, with Bitcoin standing to learn probably the most. Kruger predicts that after uncertainty across the election clears, cash will circulate into riskier belongings like crypto. “Liquidity goes to be flowing into the market,” Kruger mentioned, including that Bitcoin and different belongings might see important good points as traders shift from short-term investments to longer-term choices.

Institutional Cash on the Sidelines

Joe McCann, founding father of crypto funding agency Uneven said that institutional traders are able to pour cash into the markets whatever the election end result. “Irrespective of who wins, the view is that the market’s going larger,” McCann mentioned. He added that Trump’s pro-crypto stance might speed up Bitcoin’s rise, however even a Harris victory wouldn’t sluggish Bitcoin’s long-term upward trajectory.

Crypto’s Political Gamble

In the meantime, a latest Time article took a cautiously skeptical view of crypto’s political methods in 2024. Whereas the trade has poured large quantities of cash into campaigns and rallied grassroots supporters, it faces important challenges in public notion and regulatory hurdles. The aggressive spending and polarized techniques might both result in a breakthrough for crypto-friendly laws or trigger a political backlash that delays significant progress for years.

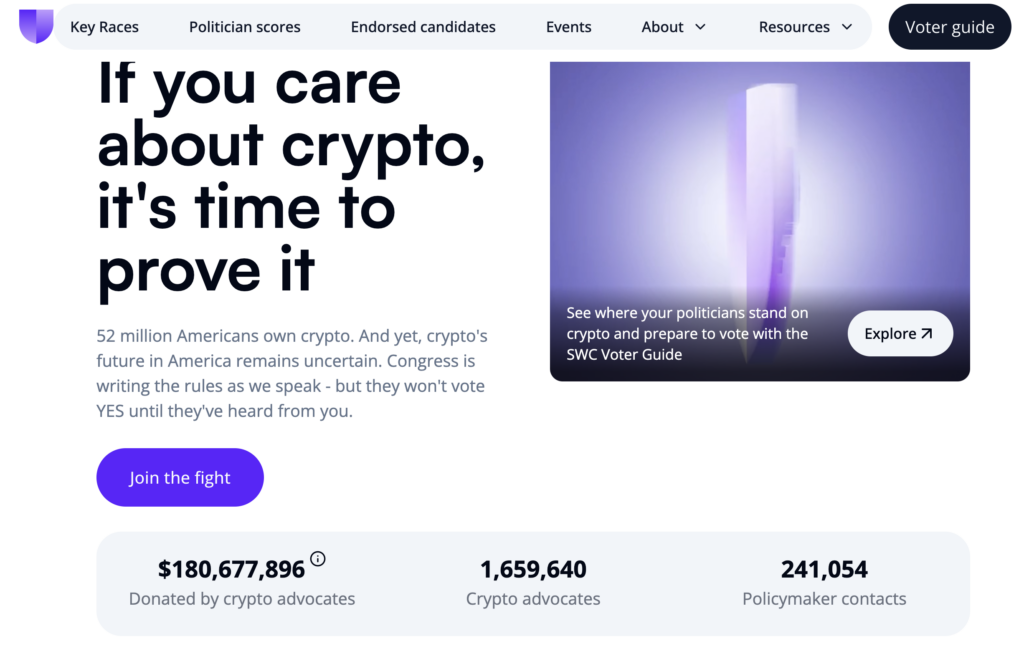

Cryptocurrency gamers are pouring important quantities of cash into political campaigns in an effort to affect U.S. elections. This contains donations to varied candidates and PACs (Political Motion Committees), significantly by means of Coinbase’s tremendous PAC, *Fairshake*, which has raised over $200 million. Cryptocurrency donations now make up almost half of all company political contributions in 2024, an enormous quantity relative to the trade’s public standing.

Regardless of this monetary clout, the article notes that the crypto trade faces challenges in gaining mainstream public approval. Polls from Pew and Gallup don’t even record cryptocurrency as a prime concern, and a Federal Reserve survey signifies that solely 7% of People owned or used crypto in 2023. Moreover, a big portion of People nonetheless harbor unfavourable opinions about crypto, with 69% of voters in swing states holding unfavorable views. The trade is battling the fallout from main scandals, such because the collapse of FTX and the legal expenses towards its founder, Sam Bankman-Fried.

The FTX collapse and Bankman-Fried’s legal actions had profound reputational penalties for your entire crypto trade. The article highlights that whereas some trade insiders thought the scandal may function a catalyst for clear federal rules, the other has occurred. The SEC, beneath Gary Gensler, has elevated its enforcement actions, suing crypto corporations and making an attempt to dam initiatives like Bitcoin ETFs. This regulatory strain has united crypto supporters of their opposition to Gensler’s strategy.

The article discusses the crypto trade’s prime legislative aim, the *FIT21* invoice, which might shift oversight of most digital belongings from the SEC to the Commodity Futures Buying and selling Fee (CFTC). The invoice handed within the Home however has but to be voted on within the Senate. The article expresses skepticism about its passage, citing political infighting and reviews suggesting that the crypto trade’s aggressive lobbying techniques might backfire. A researcher from TD Cowen wrote that crypto’s makes an attempt to sway Senate races might anger key legislators and delay any actual progress till 2026.

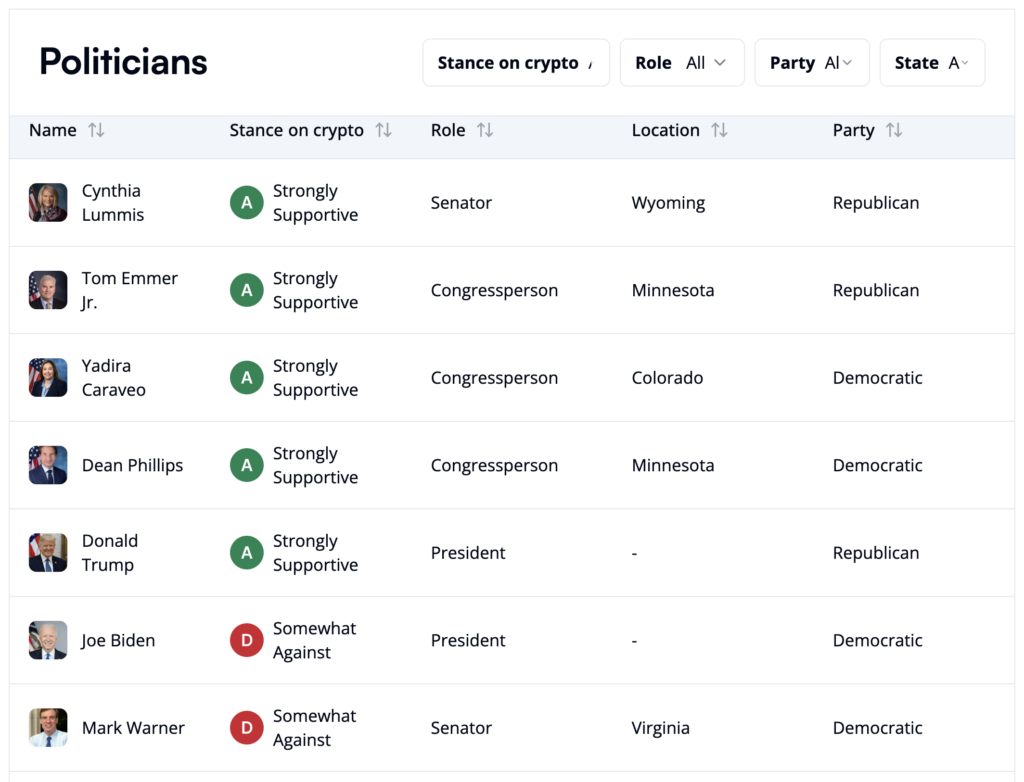

Crypto isn’t solely pouring cash into Republican candidates but in addition into some Democratic campaigns, making it a bipartisan effort. On the Republican aspect, Donald Trump has made the largest splash, pledging to fireside Gary Gensler on day one in all his presidency and positioning himself as a champion of Bitcoin. His VP choose, J.D. Vance, has additionally embraced the crypto trade as a approach to battle towards what he calls “social justice mobs.”

Nevertheless, the article notes that whereas Republicans have embraced crypto, supporting one celebration too closely might alienate Democrats, who maintain key positions on monetary regulatory issues. There’s additionally friction throughout the crypto world about the proper strategy. Some insiders fear that focusing an excessive amount of on ousting Gensler could solely deliver non permanent reduction, whereas a brand new SEC chair might nonetheless be robust on crypto. The final word aim, for a lot of, is bipartisan laws that regulates crypto pretty, no matter who’s in energy.

Influence of Lobbying and Grassroots Efforts

Crypto lobbying has taken numerous varieties. Other than monetary contributions, crypto corporations are organizing rallies and mobilizing grassroots help by means of initiatives like Stand With Crypto, a marketing campaign launched by Coinbase to generate public help for pro-crypto politicians. The article covers occasions like watch events, the place crypto fanatics collect, however notes that rallying grassroots help will be tough. At one occasion, many individuals admitted that whereas they supported crypto, they have been much less considering politics, seeing the decentralized nature of crypto as a substitute for political methods.

Supply: Stand With Crypto

Supply: Stand With Crypto

The article criticizes a few of the techniques utilized by pro-crypto PACs, describing them as opaque or counterproductive. As an illustration, *Fairshake* spent $10 million on assault adverts towards California Consultant Katie Porter, despite the fact that she had voiced little public opinion on crypto. The marketing campaign techniques confused her and others, suggesting that some trade insiders may be extra targeted on gaining affect and funding quite than supporting true crypto champions.

A key problem is passing important laws on crypto. Whereas the *FIT21* invoice has had bipartisan help within the Home, passing it by means of the Senate might show tough. The article notes that some Democratic politicians, like Nancy Pelosi, have quietly supported the invoice, however its progress is much from assured. Senate Democrats, particularly figures like Sherrod Brown, could resist crypto-friendly laws as a result of trade’s controversial popularity.

Whereas crypto’s political spending is unprecedented, it’s unclear if it’ll finally repay. The SEC stays a big adversary, and political divisions inside each the trade and U.S. events complicate the trail ahead. Crypto’s affect might develop, particularly if candidates like Trump absolutely embrace it, however there’s a threat that crypto’s aggressive spending might backfire, resulting in additional regulatory clampdowns or legislative stagnation.

Because the 2024 U.S. presidential election approaches, each the political and monetary worlds are intently watching its potential affect on markets. For the cryptocurrency trade, nonetheless, specialists recommend that the election’s end result could not considerably alter the bullish outlook for belongings like Bitcoin. With liquidity anticipated to extend and institutional cash ready on the sidelines, many consider that Bitcoin and different digital belongings are set for a robust post-election surge, no matter whether or not Trump or Harris takes the White Home.