VIRTUAL has surged 73% since its month-to-month low on Jan. 13, with the rally accelerating after the venture introduced new incentives for its ecosystem builders and neighborhood.

AI agentic platform Digital protocol (VIRTUAL) rose to $3.98, 39% increased than its intraday low on Jan. 16, whereas bringing its market cap to over $3.8 billion on the time of writing. Its day by day buying and selling quantity was additionally up 37,% hovering over $821 million amid rising buying and selling exercise.

Zooming out to its yearly features, the altcoin has surged by practically 37,000%, making it the best-performing asset among the many 100 largest cryptocurrencies, in response to information from CoinGecko.

There are three key the reason why VIRTUAL rallied at the moment.

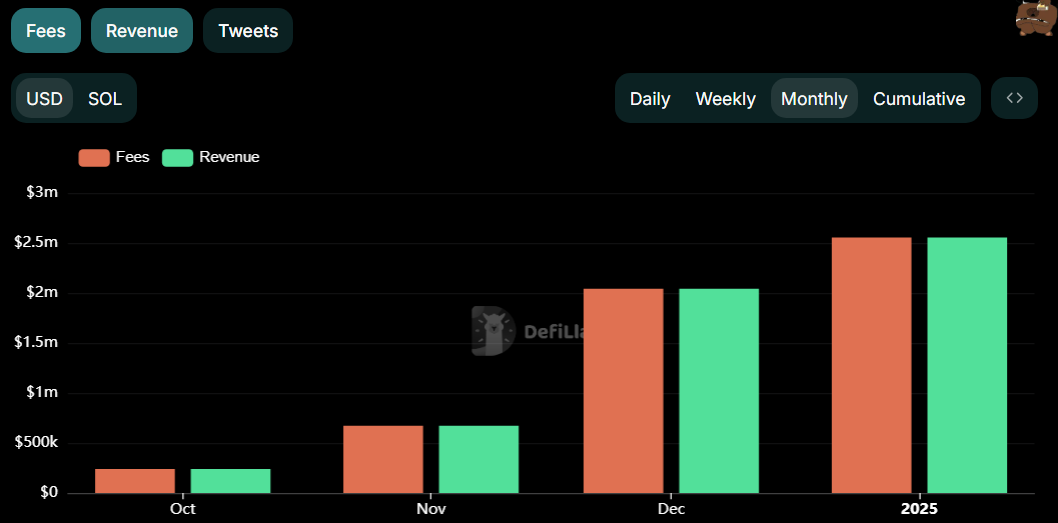

First, the venture revealed an initiative to assist the event of AI agent initiatives on the platform by offering sustainable rewards for its ecosystem builders. These rewards are funded via post-bonding taxes, that are the charges generated by the platform after the AI brokers go dwell and start working. See beneath.

Via this initiative, the Virtuals Protocol is probably going aiming to drive higher adoption of its ecosystem, which might drive curiosity and recognition from contemporary buyers. This, in flip, is predicted to contribute to long-term progress and potential worth appreciation of its main utility and governance token VIRTUAL.

Second, the venture has introduced a buyback-and-burn initiative, wherein practically 13 million VIRTUAL tokens, accrued from post-bonding buying and selling income generated by varied AI agent initiatives, might be used to burn the respective agent tokens over a 30-day interval. Token burning completely removes these tokens from the circulating provide, creating deflationary strain that may doubtlessly enhance their worth.

Third, the income generated by the Virtuals Protocol has considerably elevated over the previous months, rising from $240.68k in October to over $2.5 million by mid-January. This progress in income usually signifies an rising variety of AI brokers deployed on the platform and a better quantity of transactions amongst them, signaling a rising and thriving ecosystem—an attribute typically seen positively by buyers.

Different elements which will have contributed to VIRTUAL’s rally embody Bitcoin’s latest surge previous $100k and a rising risk-on sentiment out there, as indicated by the Crypto Worry and Greed Index shifting additional into the “Greed” zone.

VIRTUAL’s rally additionally coincided with a broader restoration of AI agent-related cash, which has rallied 12.7% over the previous day, partly pushed by the efficiency of LUNA and AIXBT—tokens from two widespread AI agentic initiatives deployed on the Digital Protocol—which recorded respective features of 24% and 27%.

VIRTUAL value motion

On the 1-day VIRTUAL/USDT chart, the token’s value stays above the 50-day Transferring Common and the 100-day Transferring Common, suggesting bulls have begun to dominate the market. That is confirmed by the Relative Power Index studying which has moved to 58.

Additional, the Common Directional Index confirmed a studying of 28. A studying above 25 signifies a transparent development energy, which, on this case, displays the rising bullish development out there.

Moreover, the Transferring Common Convergence Divergence indicator exhibits the MACD line (blue) is pointing upwards as it’s edging nearer to crossing over the sign line (orange), which is able to verify the bullish reversal.

Given these technical alerts, VIRTUAL might doubtlessly retest its all-time excessive of $5.07. A breakout above this stage might result in value discovery, with the token probably reaching $5.25, representing a 33% enhance from its present value of $3.79.

Nevertheless, if the MACD line fails to cross above the sign line, this bullish state of affairs can be invalidated, doubtlessly main the altcoin to drop towards the $2.50 psychological assist stage.