First, some context. Earlier this week, Bitcoin surged to a new all-time excessive of $109,000 per coin, doubling in worth over the previous 12 months, and propelling the whole cryptocurrency market cap—together with Bitcoin, Ethereum, XRP, and Solana—in direction of an astonishing $4 trillion.

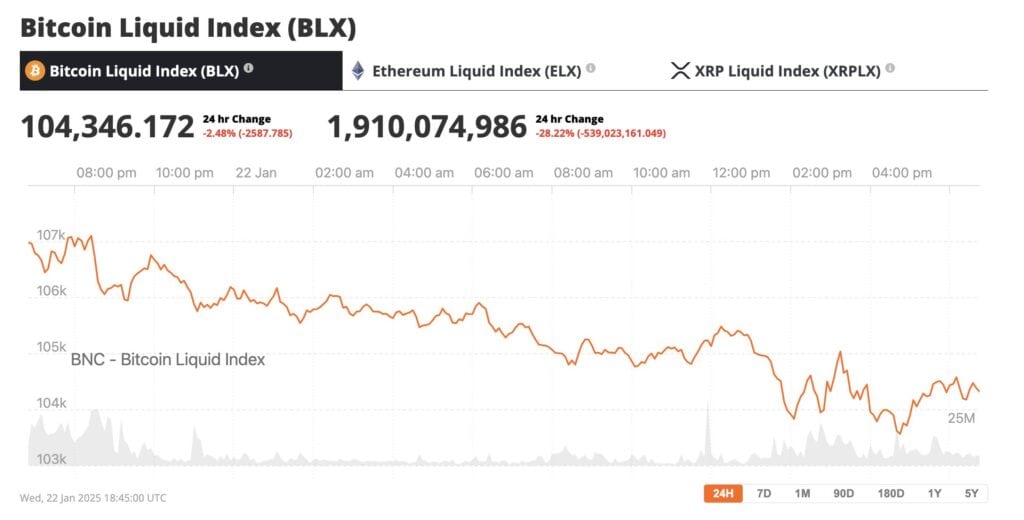

Bitcoin is all the way down to $104,000 because the market awaits pro-crypto Govt Orders. Supply: BNC Bitcoin Liquid Index

This morning, Larry Fink, CEO of BlackRock, made a daring assertion on the World Financial Discussion board in Davos. He recommended that if extra funds allotted 2% to five% of their investments into bitcoin, its value might skyrocket to between $500,000 and $700,000.

Fink, who as soon as referred to as bitcoin an “index of cash laundering,” now views it as a reliable asset and a hedge in opposition to foreign money debasement and political instability. With BlackRock main the push for crypto ETFs, and Lary Fink evolving right into a cheer chief for Bitcoin, this a massively bullish sign for your complete markets as Fink is extremely influential with monetary advisors.

Professional-Crypto Govt Orders Immediately?

Immediately, the crypto world is buzzing with expectations of pro-crypto government orders from President Trump. The primary government order is anticipated to repeal SAB 121, a regulatory guideline that required corporations holding crypto on behalf of consumers to categorise it as a legal responsibility on their steadiness sheets. The repeal can be an enormous win for the trade, because it alleviates the accounting burden and makes it simpler for companies to undertake crypto with out worry of damaging their monetary statements. This might unlock broader participation from institutional gamers and drive innovation in custodial providers.

Moreover, hypothesis swirls round what different government orders on crypto would possibly emerge, probably protecting areas like regulatory readability for stablecoins, nationwide crypto reserves for Bitcoin alt cash, frameworks for decentralized finance (DeFi), and federal-level acknowledgment of blockchain’s position in monetary infrastructure. Collectively, these strikes will catalyze the subsequent part of mainstream crypto adoption, fostering a friendlier surroundings for funding and innovation.

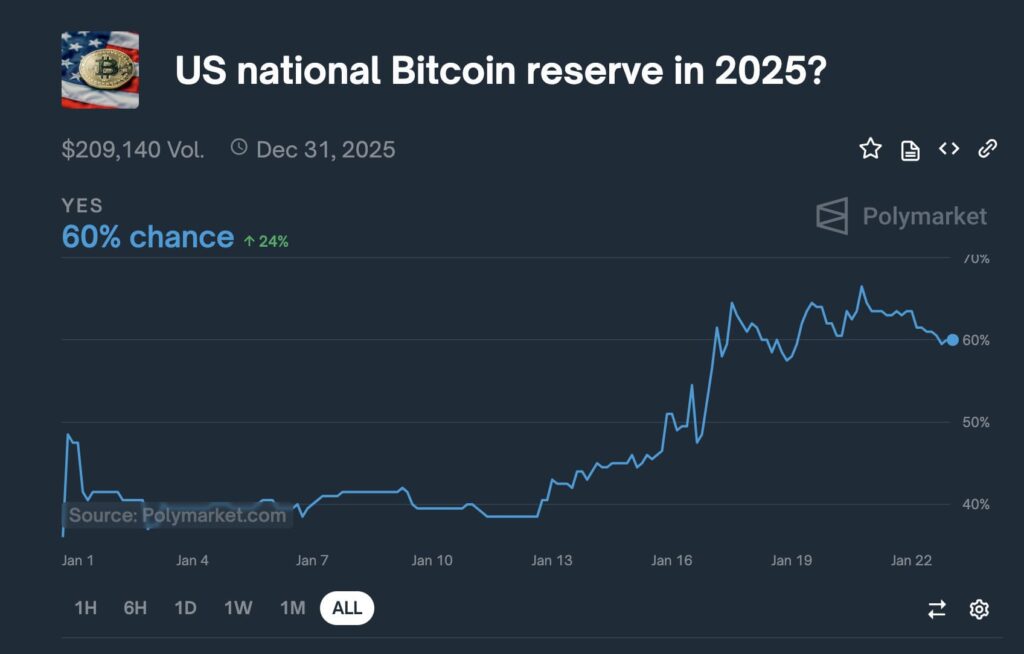

Merchants are significantly optimistic about Trump’s proposed U.S. Strategic Bitcoin Reserve, which betting website Polymarket now pegs at a 60% probability, up 20% from final week.

The percentages of a U.S. Strategic Bitcoin Reserve are as much as 60%. Supply: Polymarket

As excited as we’re about Bitcoin, with Trump making ready to unleash American innovation, it’s Ripple’s XRP that has the strongest bull case proper now. There are 5 key causes for this. If you’re seeking to construct a thesis for a rise within the XRP value in 2025, right here is our bullish value prediction for Ripple and the XRP coin. Listed here are 5 prime causes to be lengthy XRP.

1. XRP to Lead the America-First Crypto Reserve?

Stories counsel the Trump administration would possibly develop its crypto reserve plans to function U.S.-developed cryptocurrencies akin to Ripple’s XRP and Solana. This proposed “America-First Strategic Reserve” would come with Solana (an Ethereum rival), USDC (a stablecoin issued by Circle and supported by Coinbase), and XRP (created by Ripple for cross-border funds).

The New York Put up, citing nameless sources, reported that Trump is “receptive” to those concepts after discussions with Ripple CEO Brad Garlinghouse and Coinbase CEO Brian Armstrong. Hypothesis intensified when Garlinghouse was photographed with Trump at Mar-a-Lago, elevating questions concerning the administration’s crypto technique.

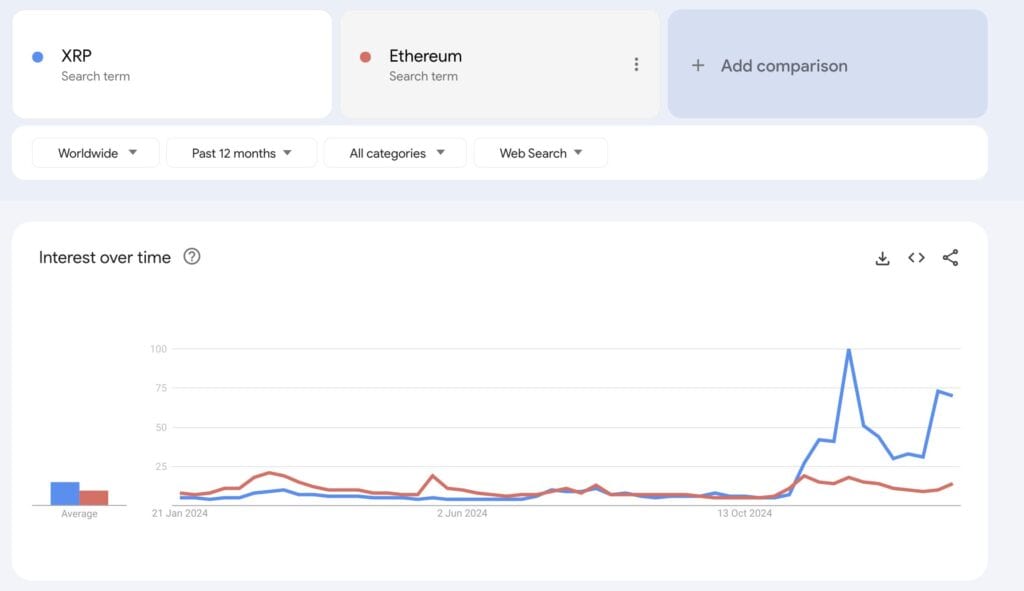

Ripple’s XRP has soared 500% since Trump’s November election win. Retail traders are flocking to XRP, which briefly surpassed Bitcoin in Google search curiosity, and has utterly overshadowed Ethereum in google searches. There’s rising hypothesis that the whole market capitalization of XRP might overtake Ethereum this 12 months.

XRP Google Searches have overtaken Etherem, Supply Google

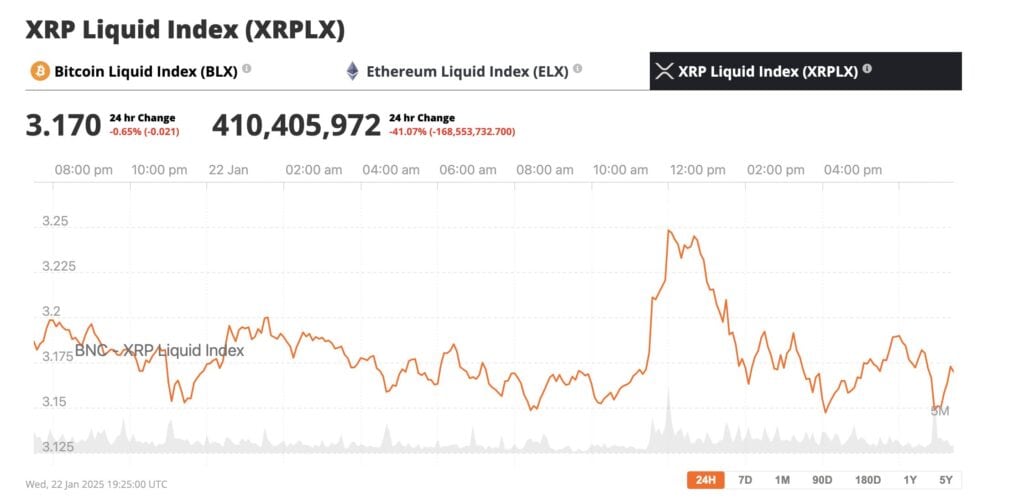

This week’s information of XRP’s potential inclusion in an American Crypto Reserve despatched costs greater, earlier than some profit-taking noticed it dip barely. XRP is down 0.65% within the final 24 hours however up a staggering 498% over the previous 90 days.

XRP is setting at 3.170, down barely in a single day, up 498% over 90 days. Supply: XRPLX

2. Robust Regulatory Tailwinds for Ripple’s XRP

Crypto markets are anticipating a big shift in regulation with Trump’s victory. Trump’s choose for SEC Chair, Paul Atkins, is understood for his crypto-friendly stance and is anticipated to push for clear tips fostering innovation. This might ease the regulatory pressures which have plagued Ripple and the broader trade underneath Gary Gensler’s management.

Trump’s Daring Crypto Agenda

Highlights of Trump’s pro-crypto plans embrace:

- Loosening Rules: Rapid rollbacks of restrictive crypto-focused insurance policies.

- Reversing Biden-Period Guidelines: Eliminating the requirement for banks to deal with digital belongings as liabilities.

- Selling Crypto Freedoms: Lowering compliance burdens to spur entrepreneurial development.

- Unified Federal Oversight: Establishing a clear framework to exchange fragmented state and federal guidelines.

- XRP ETF Approval: Spot XRP ETFs might acquire approval by 2025, opening new funding channels.

- Bitcoin Strategic Reserve: A nationwide Bitcoin reserve to hedge in opposition to fiat instability and place the U.S. as a digital financial system chief.

Minutes in the past, CME added a XRP and SOL futures web page to their staging subdomain. Web page says XRP and SOL futures are going stay on Feb 10 pending regulatory evaluation. Appears like they’re making ready for the official announcement. Which means a Ripple XRP ETF is imminent.

XRP and SOL futures web page on the CME staging subdomain Supply: X

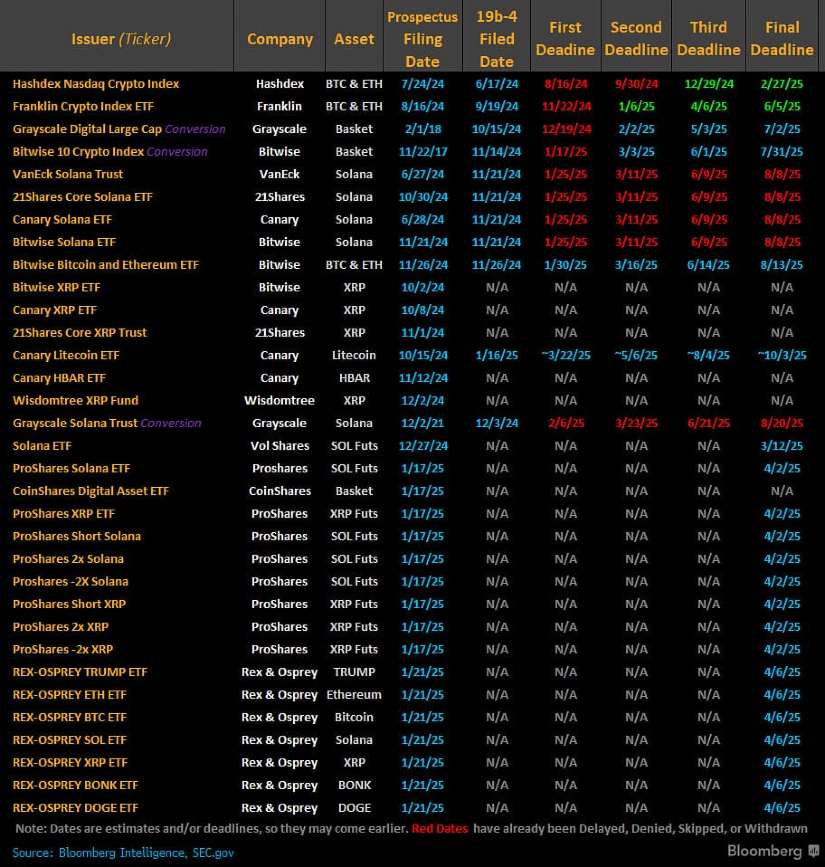

Yesterday, Bloomberg analyst James Seyffart posted on X a listing of the present digital asset ETF filings. Notable, is the numerous separate filings for XRP ETFs by Bitwise, Canary and extra. These are actually prone to be authorised by the brand new pro-crypto SEC. Supply: X

3. A New Professional-Crypto SEC Will Finish Its Case in opposition to Ripple

Yesterday’s shake-up on the SEC is a possible game-changer for Ripple and XRP. With the resignation of SEC Chair Gary Gensler and the appointment of pro-crypto Mark Uyeda as appearing chair, the regulatory winds appear to be shifting. Uyeda’s favorable stance on digital belongings might result in a extra supportive surroundings for cryptocurrencies. This variation is especially important for Ripple, which has been entangled in a authorized battle with the SEC over allegations of unregistered securities choices. A management extra attuned to the nuances of crypto might pave the way in which for a decision in Ripple’s favor.

Furthermore, the SEC’s formation of a “crypto job power” led by Commissioner Hester Peirce, often known as “Crypto Mother” for her supportive views on digital belongings, alerts a transfer towards clearer regulatory frameworks. This initiative goals to guard traders whereas fostering innovation within the crypto market.

For Ripple and XRP, this might imply a extra outlined and favorable regulatory panorama, lowering uncertainty and inspiring institutional adoption. The market’s constructive response, with XRP’s value experiencing a notable uptick, displays rising investor confidence in Ripple’s future prospects underneath this new SEC management.

In truth, we’re certain the case will now be quietly resolved, letting Ripple give attention to tech innovation, and taking the shackles off XRP so it might probably enter full value discovery mode.

4. Ripple and XRP: Positioned for Disruption

Ripple’s XRP was designed to handle inefficiencies in world funds, enabling quick, safe, and cost-effective cross-border transactions. Not like Bitcoin, which is slower and costlier, XRP processes 1000’s of transactions per second. RippleNet, XRP’s underlying community, is already being utilized by monetary establishments globally, and the potential market disruption is immense.

Nonetheless, challenges stay. Critics level out that RippleNet can function with out XRP, lowering the “provide shock” impact which may drive costs greater. However Ripple’s pivot towards tokenization may very well be the game-changer.

Ripple’s Imaginative and prescient: Remodeling Finance Via Tokenization

Ripple is evolving past funds into tokenization, concentrating on the $55 trillion U.S. asset market. Latest acquisitions, akin to Metaco and Normal Custody, strengthen Ripple’s infrastructure for tokenized belongings. The launch of Ripple USD (RLUSD), a NYDFS-regulated stablecoin, enhances its ecosystem and monetization potential.

Ripple’s partnerships with main gamers place it as a frontrunner in tokenization. The XRPL’s capability to deal with quick, low-cost tokenization at scale will unlock trillions in alternatives, redefining world finance.

5. Technicals Look Robust for Ripple’s XRP

Lastly, let’s finish with a chart. On X, evaluation CryptoWizard wrote, “HUGE $XRP SIGNAL. What if it’s solely simply starting? On the Quarterly Chart XRPBTC is breakout out of a HUGE W-Sample A breakout will lead to a CRAZY BULLISH RALLY that may depart you speechless. XRP Value Goal is is $4.00, however we gained’t cease there…”

XRP With a value prediction of $4, Supply: X

Bullish Outlook for XRP and Crypto

Trump’s pro-crypto stance, mixed with Ripple’s developments, and XRP’s bullish technicals units the stage for an enormous bull run. With regulatory readability and institutional backing, XRP and different digital belongings might hit new all-time highs. The crypto moonshot begins now. Buckle up and see you on the moon!