The cryptocurrency market is abuzz with exercise as institutional traders, referred to as “whales,” have seized the chance to build up over 34,000 Bitcoin (BTC) following its December worth correction.

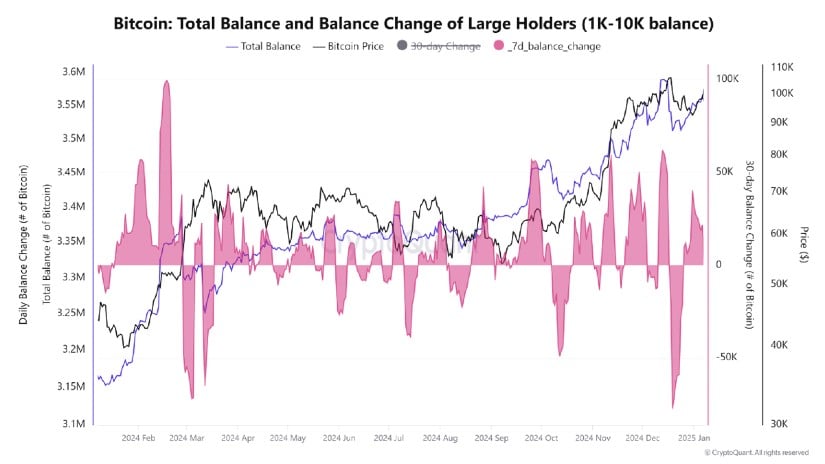

Knowledge from Blocktrends and CryptoQuant reveals that these massive holders strategically bought BTC price roughly $3.2 billion after a pointy market dip triggered by Bitcoin’s peak of over $108,000 on December 17, 2024.

December Promote-Off: A Calculated Transfer?

Within the days after Bitcoin’s peak, wallets holding 1,000 to 10,000 BTC collectively bought 79,000 BTC, triggering a 15% correction. In accordance with Blocktrends’ head of analysis, Cauê Oliveira, this sell-off coincided with the U.S. Federal Reserve’s rate of interest lower. Nonetheless, these identical institutional gamers returned to the market, benefiting from costs beneath $95,000 to rebuild their positions by smaller, fragmented trades.

Bitcoin’s seven-day stability change turns optimistic following a late-December sell-off of almost 80,000 BTC, signaling renewed market exercise. Supply: CryptoQuant

“This calculated accumulation underscores the strategic method of huge gamers who capitalize on market consolidations,” Oliveira defined in a January 8 CryptoQuant put up.

Market Alerts: A Shift Towards Restoration

Bitcoin’s seven-day stability change has flipped optimistic following the late-December sell-off. This means renewed shopping for strain, which might assist stabilize the market. By January 7, Bitcoin was buying and selling round $94,900, down 2.3% for the day amidst broader market weak point attributable to U.S. financial information.

Bitfinex analysts additionally famous a pointy discount in sell-side liquidity, suggesting that the worst of the downward worth strain may be over. “Shrinking liquidity usually foreshadows a interval of stabilization,” they acknowledged in a January 6 market observe.

Professional-Crypto Insurance policies Gas Optimism

The incoming U.S. administration beneath President-elect Donald Trump is anticipated to undertake pro-crypto insurance policies, additional boosting market confidence. Constancy Digital Property anticipates that central banks, sovereign wealth funds, and authorities treasuries will more and more view Bitcoin as a strategic asset.

In a latest analysis paper, Constancy analyst Matt Hogan acknowledged, “Extra institutional gamers are prone to allocate Bitcoin of their portfolios, setting the stage for a possible rally.”

Value Predictions: Can Bitcoin Attain New Heights?

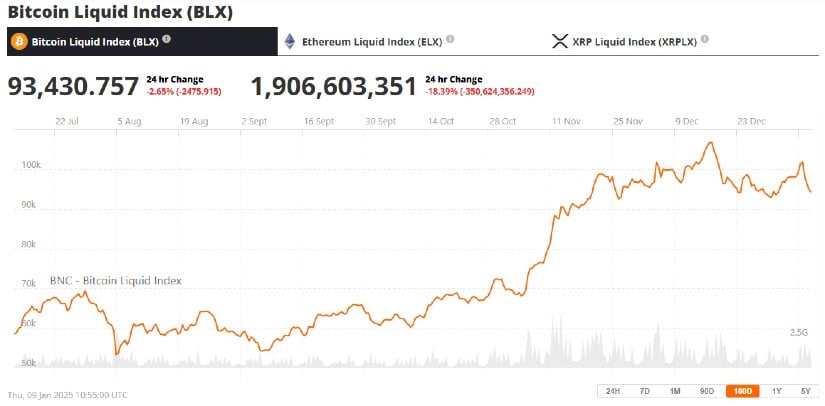

Specialists provide various predictions for Bitcoin’s trajectory in 2025. Blockware analysts counsel that if the U.S. authorities adopts a Bitcoin reserve, costs might surge to between $150,000 and $400,000.

Bitcoin (BTC) worth chart. Supply:Bitcoin Liquid Index (BLX) through Courageous New Coin

Nonetheless, some bearish indicators stay. Bitcoin just lately shaped a bearish engulfing candle after briefly testing the $100,000 mark, signaling the potential of additional corrections beneath $90,000. Analysts warn that historic information reveals solely a 20% probability of instant restoration after dips exceeding 5%.

Stablecoins and Market Liquidity

Crypto analyst Miles Deutscher highlighted the rising provide of stablecoins, which might improve market liquidity. “Stablecoins getting into worth discovery usually precede important strikes in Bitcoin,” he famous.

In the meantime, Jamie Coutts identified Bitcoin’s resilience regardless of the strengthening U.S. greenback, indicating strong demand. Nonetheless, short-term volatility stays a priority as merchants eye assist ranges between $90,000 and $92,000.

Wanting Forward

Bitcoin’s latest worth actions illustrate its unstable and dynamic nature. Institutional accumulation is offering much-needed assist for restoration, however bearish technical patterns and broader market components counsel warning.

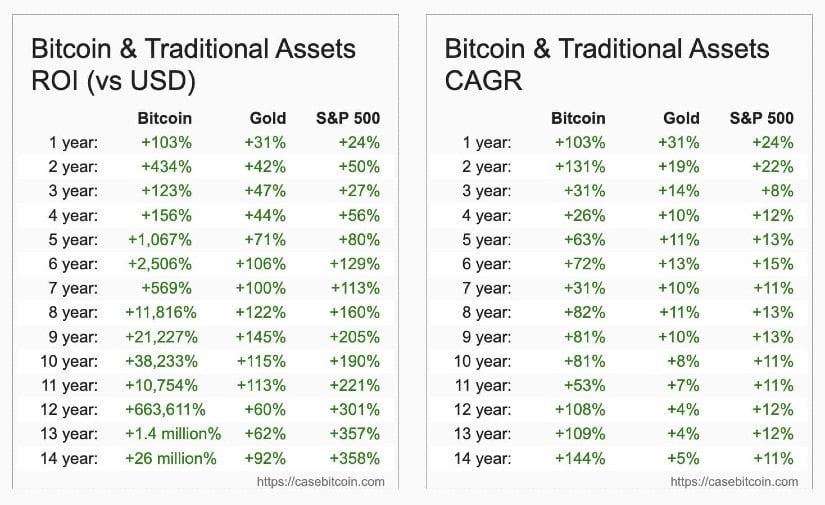

As pro-crypto insurance policies and rising institutional adoption form the market, Bitcoin’s long-term outlook for 2025 is promising with Trump’s inauguration simply days away. Nonetheless, merchants ought to stay ready for potential worth swings within the weeks forward. However for brand new traders new to crypto? Those that are questioning what crypto to purchase proper now? Properly, Bitcoin stays the most secure wager, particularly in the event you’ve obtained a very long time horizon of ten years or extra.

The numbers don’t lie, and so they present that Bitcoin is clearly one of the best performing asset over a very long time interval. Supply: Casebitcoin