Ark Make investments CEO Cathie Wooden has doubled down on her bullish stance on Bitcoin, forecasting the cryptocurrency might attain as excessive as $1.5 million by 2030 in her most optimistic state of affairs, highlighting the rising institutional acceptance of digital property in mainstream finance.

In a current interview on CNBC, she reaffirmed her bullish stance on Bitcoin, forecasting that the cryptocurrency might attain as excessive as $1.5 million by 2030. Wooden’s optimistic outlook comes amid rising institutional curiosity and anticipated regulatory readability within the digital asset house.

$1.5 million by 2030

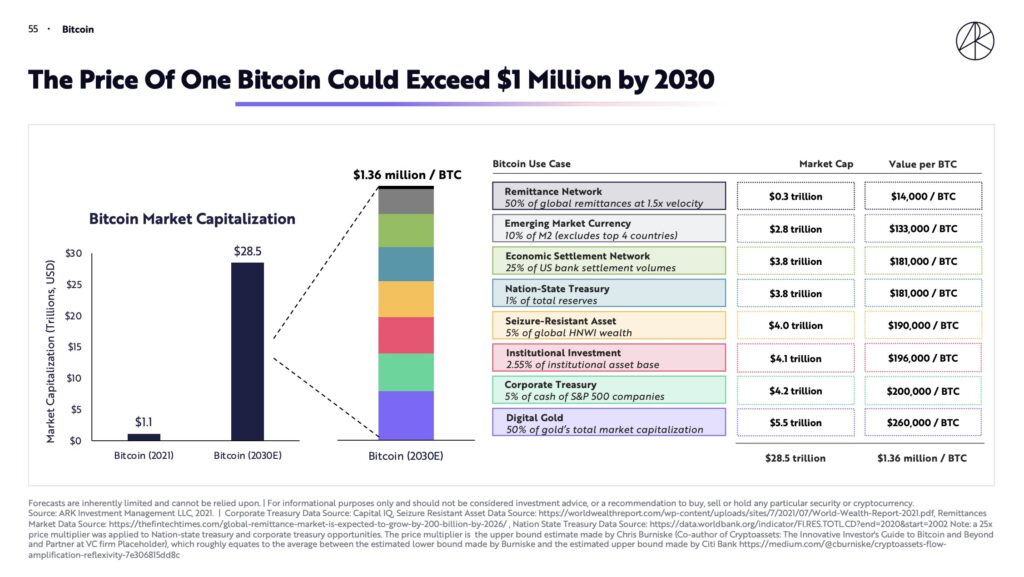

“We have now a 2030 goal; in our base case, it’s round $650,000, and in our bull case, it’s between $1 million and $1.5 million,” Wooden acknowledged. She emphasised that Bitcoin is evolving past a worldwide financial system to develop into a brand new asset class altogether. “Establishments and asset allocators are saying, ‘Wait a minute, this asset is behaving in a different way from all of our different property; we have to embrace it.’ So I feel that’s the following large transfer,” she added.

ARK Funding was one of many earliest public asset managers to achieve publicity to Bitcoin, investing within the cryptocurrency when it was priced at simply $250 in 2015. Wooden famous that regardless of Bitcoin’s important appreciation since then, presently buying and selling round $90,000, she believes there may be substantial room for development. “We nonetheless suppose now we have a protracted method to go,” she stated.

Supply: ARK

One of many key elements driving Wooden’s optimism is the potential for regulatory reduction beneath the present U.S. administration. “We’re getting regulatory reduction right here, and I feel that’s one of the crucial vital issues popping out of this administration,” she defined. “We are going to get regulatory reduction on all types of innovation, together with healthcare.” The anticipation is that clearer laws will cut back uncertainty and encourage extra institutional participation within the cryptocurrency market.

Wooden additionally highlighted the macroeconomic setting as a catalyst for Bitcoin’s ascent. With inflation charges stabilizing, she urged that Bitcoin might see a “good large transfer” as traders search property that behave in a different way from conventional equities and bonds. “In years the place the Bitcoin halving has occurred and the inflation charge has gone all the way down to 0.9%, it’s normally had a pleasant large transfer,” she noticed.

Regardless of criticism and skepticism from some quarters, Wooden stays steadfast in her convictions. Addressing a query a couple of essential article that questioned why anybody ought to hearken to her, she responded confidently: “We have now a unstable fund; we shouldn’t be an enormous slice of any portfolio. We’re extra of a satellite tv for pc technique, though we predict that is the best way the world goes.”