Cardano has surged over 10%, breaking a key resistance stage, and is now testing greater costs. Regardless of the bullish momentum, on-chain knowledge reveals that long-term holders are starting to take earnings. The ratio of day by day on-chain transactions in revenue to loss has turned constructive, suggesting that many buyers are capitalizing on current good points.

Associated Studying

Because the market continues to evolve, ADA strives to keep up its uptrend, buoyed by constructive sentiment and rising optimism for additional worth restoration. Nevertheless, this profit-taking exercise signifies that some buyers are cautiously locking in good points, doubtlessly resulting in short-term worth volatility.

With excessive expectations for a continued rally within the coming weeks, buyers are carefully watching ADA’s efficiency to see if it might maintain its momentum. The subsequent few days can be crucial for confirming whether or not Cardano can maintain above these ranges and push towards new highs.

Cardano Lengthy-Time period Holders Promoting

Cardano is testing native provide ranges after a major surge, with buyers changing into cautious of their short-term methods.

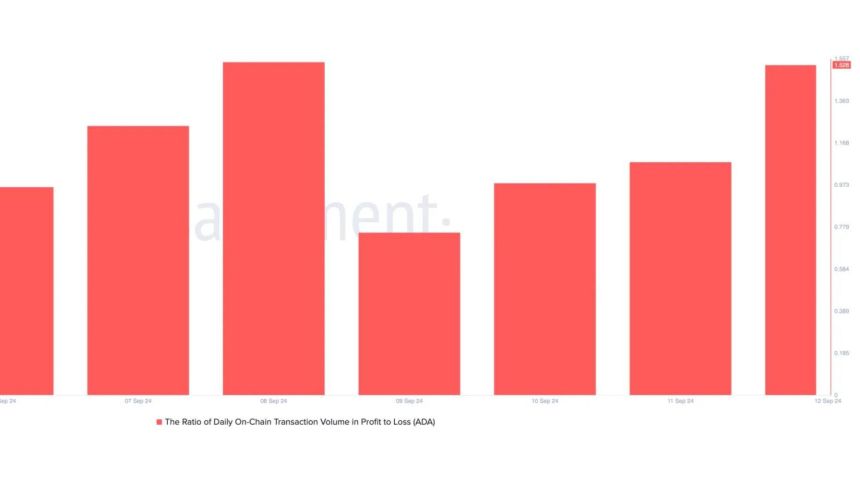

Yesterday, the ratio of day by day on-chain transactions in revenue to loss reached 1.53, that means that for each ADA transaction leading to a loss, 1.53 transactions have generated earnings. This metric highlights that many buyers are making the most of the current worth good points, resulting in some long-term holders promoting their cash for revenue.

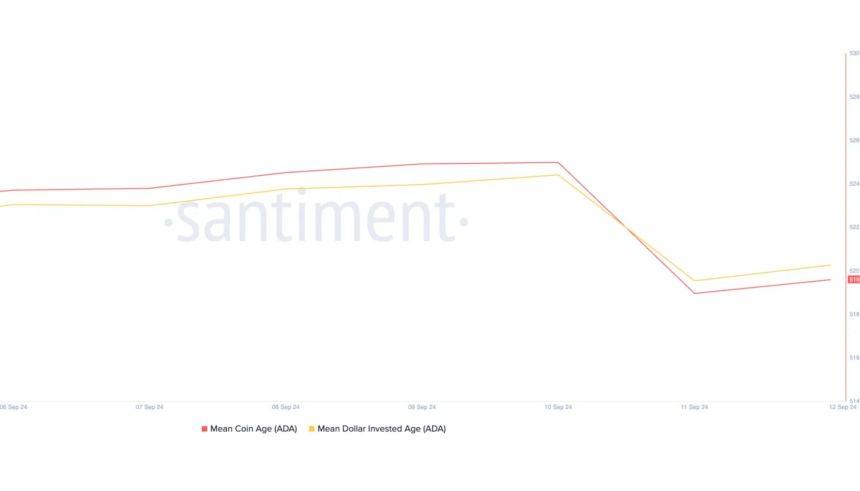

Information from Santiment helps this view, displaying a slight decline in Cardano’s Imply Coin Age and Imply Greenback Invested Age on September 11. These metrics monitor long-term holders’ habits, reflecting the typical age of ADA cash and the quantity invested over time. A drop in these metrics means that holders who bought ADA at decrease costs at the moment are taking earnings, reducing the typical age of the cash of their possession.

Regardless of this promoting strain, ADA nonetheless has the potential to keep up its bullish momentum if market circumstances proceed to push. Cardano might goal greater costs, however the cautious habits from seasoned buyers indicators that the rally would possibly face resistance quickly.

Associated Studying: Is Chainlink (LINK) $12 Breakout Imminent? Information Reveals A Rising Open Curiosity

The approaching days can be essential for ADA, because it wants to carry above its present ranges to verify a continued uptrend. If consumers regain management and demand will increase, Cardano might break by key resistance ranges and purpose for brand spanking new highs.

ADA Worth Motion Particulars

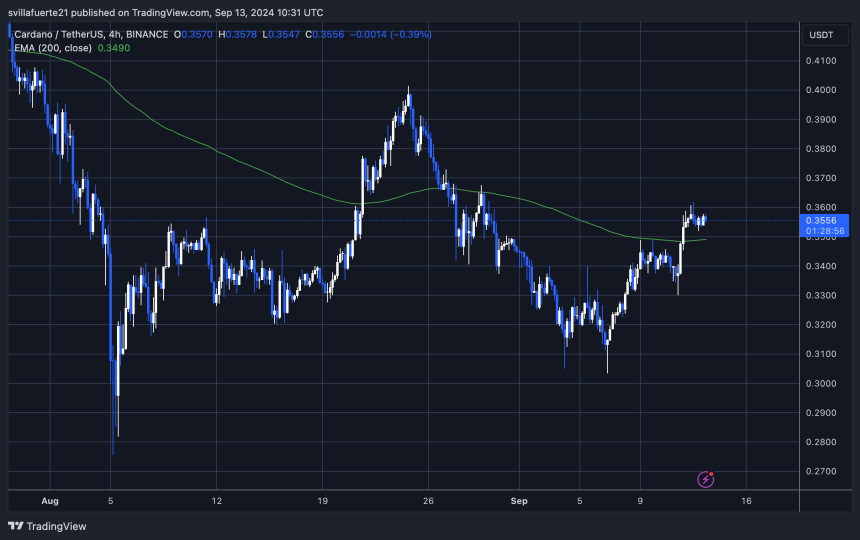

ADA trades at $0.3565 after testing a key resistance at $0.36. The worth has closed above the 4-hour 200 exponential shifting common (EMA) at $0.3490.

This can be a important indicator of short-term energy that ADA had revered as resistance since early August. This profitable reclaim of the 4H 200 EMA is essential for sustaining the uptrend.

If ADA manages to retest this EMA and maintain it as assist, it might verify a short-term bullish development. Breaking and holding above this stage means that ADA might proceed to push upward. Traders and analysts see the subsequent goal as being within the $0.38 to $0.40 vary.

Associated Studying

Nevertheless, if ADA loses this assist stage, the value might drop to decrease demand zones, probably retreating to round $0.33. This might sign a weakening present momentum and doubtlessly spark additional promoting strain.

Featured picture from Dall-E, chart from TradingView