Bitcoin has reached new all-time highs for 4 consecutive days, hitting $99,500 simply hours in the past. The relentless surge has fueled excessive bullish sentiment available in the market, with buyers eagerly anticipating Bitcoin’s historic breakthrough of the $100,000 mark. Nevertheless, on-chain information means that the rally might face challenges as indicators of profit-taking emerge.

Associated Studying

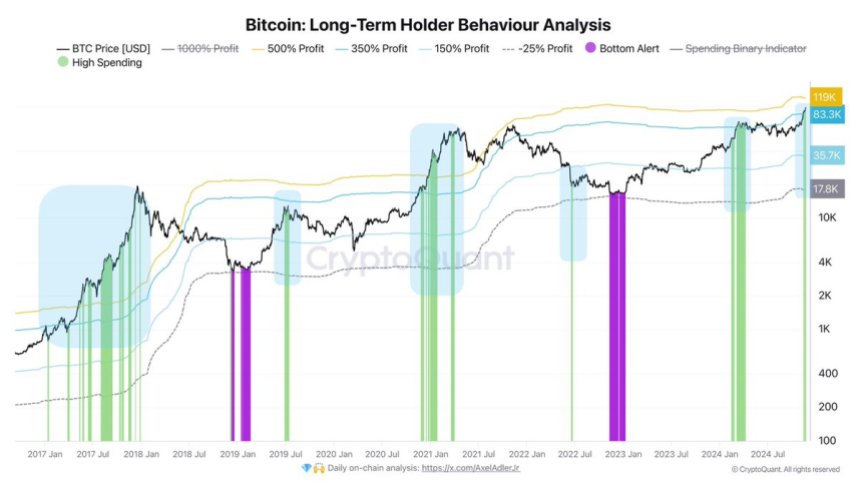

Key insights from CryptoQuant reveal that Lengthy-Time period Holders (LTHs) are actively spending their Bitcoin, capitalizing on earnings exceeding 350%. This conduct signifies that some seasoned buyers are starting to lock in positive aspects after the aggressive uptrend. Whale exercise and profit-taking by LTHs might quickly gradual the rally, probably triggering a consolidation section earlier than the following leg up.

Whereas Bitcoin stays shy of the six-figure milestone, the market carefully examines whether or not it will probably maintain its momentum or if a pullback is imminent. Consolidation at these ranges might present the muse for BTC to reclaim its bullish pattern and break via the psychological $100,000 barrier.

Bitcoin Rally Appears Unstoppable

Bitcoin has surged a powerful 45% since November 5, displaying relentless upward momentum that seems unstoppable. Regardless of growing promoting exercise, demand continues to assist the worth, driving Bitcoin to new highs and sustaining its bullish trajectory. Market members at the moment are carefully looking forward to potential alerts of a slowdown or correction as BTC pushes deeper into uncharted territory.

CryptoQuant analyst Axel Adler not too long ago shared X information highlighting a big pattern amongst Lengthy-Time period Holders (LTHs). In line with Adler, LTHs are actively spending their Bitcoin, capitalizing on earnings exceeding 350%. This marks a important juncture, as these holders are sometimes considered market stabilizers, and their promoting exercise might point out potential shifts in sentiment.

Adler additional notes that if Bitcoin’s worth surpasses $119,000, LTH earnings would soar to over 500%. Such extraordinary revenue ranges might set off a wave of promoting strain, probably resulting in the primary main correction after this unprecedented rally. Nevertheless, he emphasizes that predicting a precise worth level for a correction stays speculative, as no definitive threshold exists to find out when LTHs would possibly overwhelmingly exit their positions.

Associated Studying

Whereas the rally exhibits no indicators of slowing down, this dynamic between demand and LTH profit-taking underscores the significance of monitoring market conduct. Merchants ought to stay cautious as Bitcoin’s fast ascent unfolds.

BTC About To Attain $100K

Bitcoin trades at $98,600, lower than 2% from the extremely anticipated $100,000 mark. This psychological stage is anticipated to be a big provide zone, with many buyers carefully watching worth actions round this milestone. Latest “solely up” worth motion has left little room for merchants to purchase at decrease ranges, irritating those that hoped to build up throughout dips.

If Bitcoin holds above the essential $93,500 assist stage within the coming days, market sentiment suggests a robust surge above $100,000 might comply with. Breaking this barrier would possible usher in additional bullish momentum, pushing Bitcoin into uncharted territory and fueling optimism for extra positive aspects.

Nevertheless, failure to keep up assist at $93,500 might set off promoting strain, resulting in a worth pullback. In such a state of affairs, Bitcoin would possibly take a look at decrease demand zones, with $85,000 and $80,000 recognized as key ranges to look at. These zones might present new accumulation alternatives for buyers trying to capitalize on worth corrections.

Associated Studying

As Bitcoin approaches this historic stage, the following few days will decide whether or not the market sustains its bullish pattern or enters a consolidation section. Merchants and buyers ought to stay vigilant as BTC navigates this important juncture.

Featured picture from Dall-E, chart from TradingView