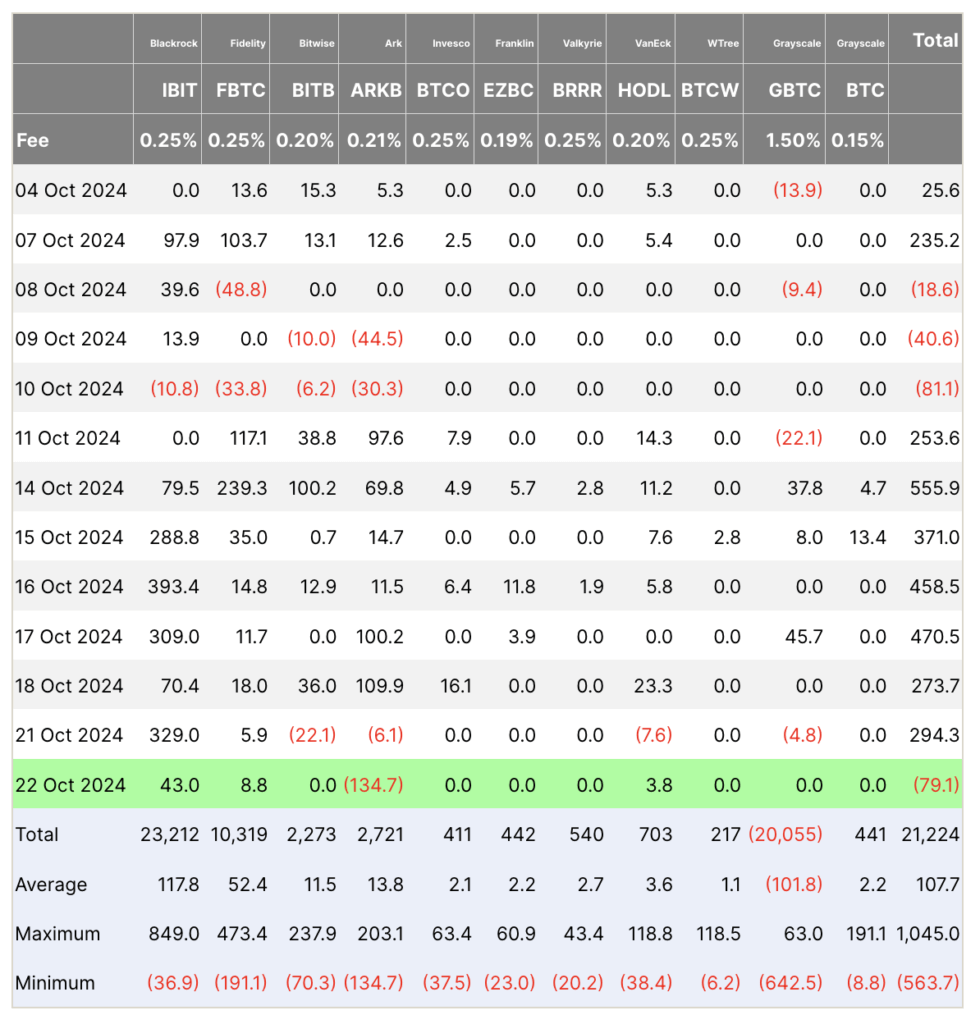

Bitcoin exchange-traded funds (ETFs) registered internet outflows on Oct. 22, 2024, halting a seven-day streak of inflows that had accrued over $2.6 billion since Oct. 11. The whole outflow amounted to $79.1 million, marking the primary unfavorable circulation since Oct. 10.

The iShares Bitcoin Belief (IBIT) reported inflows of $43 million on Oct. 22, a lower from its earlier each day positive aspects. In distinction, ARK’s Bitcoin ETF (ARKB) skilled important outflows of $134.7 million, contributing to the general unfavorable determine. Different funds, reminiscent of Constancy’s FBTC and VanEck’s HODL, noticed minor inflows, whereas others recorded flat flows.

This shift follows constant investor curiosity in Bitcoin ETFs, which had seen substantial capital inflows over the previous week.

Analysts are monitoring these developments to evaluate whether or not this outflow is a short lived fluctuation or the start of a brand new development. The efficiency of main ETFs like IBIT might be essential in understanding future market actions.