As crypto fan Donald Trump prepares to take the reins of the federal government, the U.S. Client Monetary Safety Bureau has pitched new laws that will have a major affect on stablecoin issuers and pockets suppliers, although the proposal’s future stays in query.

The CFPB took the primary procedural step to open a proposal to public touch upon Friday that will arrange a framework to use the Digital Fund Switch Act to digital wallets and stablecoins – the digital tokens tied to the worth of a gradual asset, generally the U.S. greenback. Whereas that has heavy implications to the best way U.S. stablecoin companies and crypto pockets suppliers would do enterprise, it is at a preliminary stage with Trump about to reach on the White Home with the ability to nominate a brand new CFPB chief.

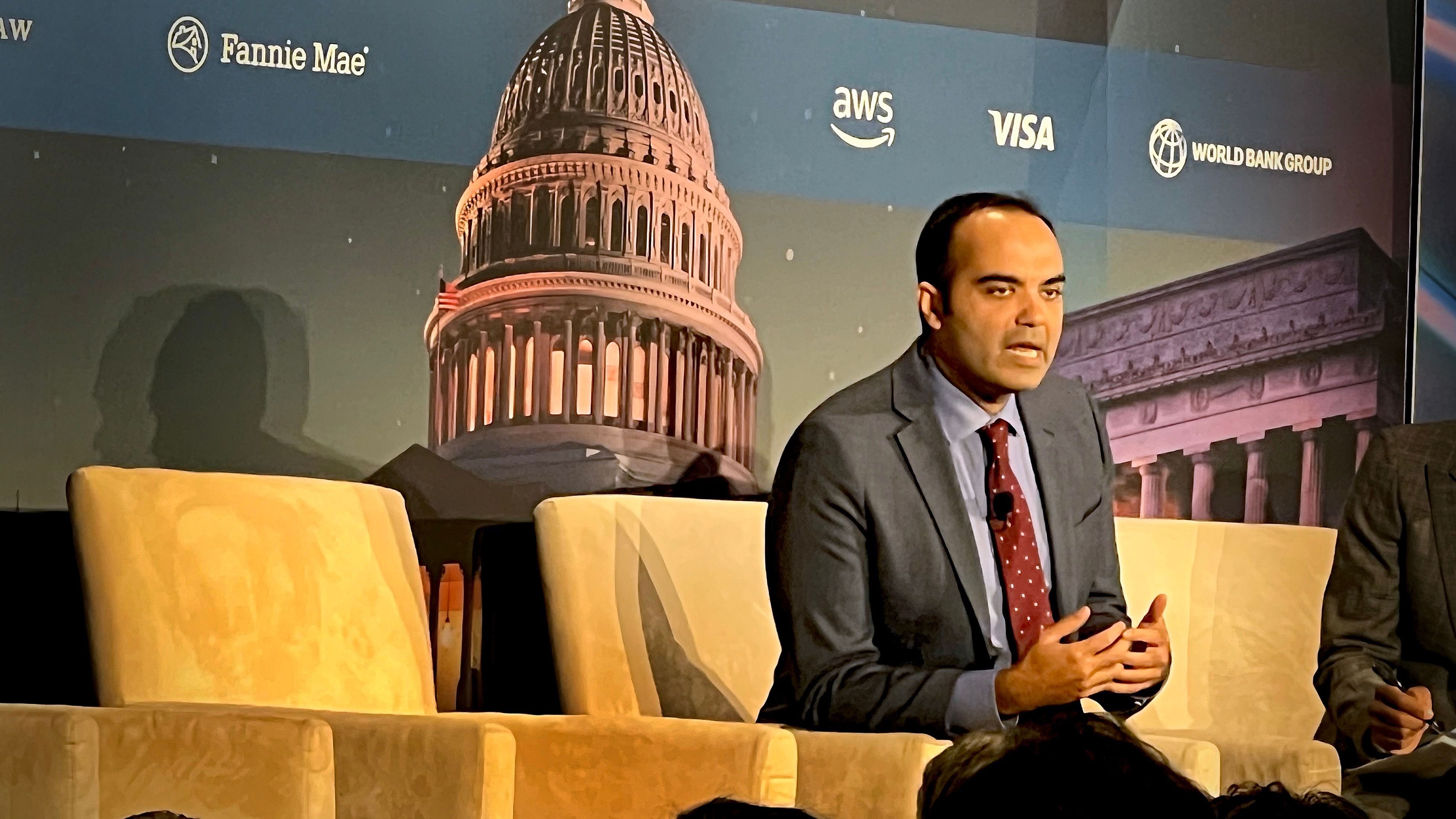

In contrast to different company heads, equivalent to these on the Securities and Alternate Fee and the Commodity Futures Buying and selling Fee, CFPB Director Rohit Chopra seems unlikely to step down voluntarily. Because the company’s creation after the 2008 world monetary meltdown, its leaders have usually occupied a extra aggressive posture than different regulators, and Republican lawmakers have actively sought to weaken the CFPB’s powers.

In 2020, the Supreme Courtroom confirmed the president can fireplace and substitute the director at will – an influence Trump is anticipated to train.

This last-minute regulatory effort must survive the arrival of a Trump-appointed chief earlier than it might be finalized and enforce. Even when this have been a ultimate rule, the Republican-led Congress would have an opportunity to erase it with its Congressional Assessment Act authority.

Have been it to outlive, the regulation as proposed – and now opened for a public remark interval – appears at stablecoins as a fee mechanism. The prevailing regulation’s reference to “funds” ought to embody stablecoins, the proposal suggests, and it might arguably additionally embody different extra unstable cryptocurrencies equivalent to bitcoin. “Underneath this interpretation, the time period ‘funds’ would come with stablecoins, in addition to another similarly-situated fungible property that both function as a medium of change or as a way of paying for items or companies,” the proposal acknowledged.

It moreover stated the regulation’s attain into monetary “accounts” ought to embody “digital forex wallets that can be utilized to purchase items and companies or make person-to-person transfers,” particularly in the event that they’re getting used for retail transactions and never the shopping for and promoting of securities or commodities.

Establishments who present such accounts would fall underneath regulatory necessities to make client disclosures and supply protections in opposition to unauthorized transactions and the power to cancel improper transfers. These authorities calls for might run afoul of the best way crypto operations are sometimes arrange – equivalent to in decentralized finance (DeFi) – as person-to-person platforms with out exterior interference, or with pockets expertise offered for customers to run themselves.

Client advocacy group Higher Markets applauded the company’s proposal on Friday.

“The CFPB’s proposal at this time extends the EFTA protections to non-bank digital fee mechanisms,” Dennis Kelleher, the group’s president, stated in an announcement. “That may not solely defend customers, but in addition stage the enjoying subject amongst digital fee mechanisms whether or not involving a financial institution checking or financial savings account or one other client asset account equivalent to these utilized by crypto and online game companies.”

The Cato Institute’s Jack Solowey, a coverage analyst on the conservative assume tank, countered in a submit on social-media web site X that the CFPB’s arguments for this rule are “embarrassingly conclusory,” with out even coping with decentralized ledgers and self-hosted wallets.

Invoice Hughes, director of worldwide regulatory issues at Consensys, the Ethereum growth firm, additionally railed in opposition to the transfer on X, suggesting, “Add this to the record of ‘regulation by decree’ issues that must be mounted.”