Bitcoin is navigating turbulent waters as its value continues to slip, looking for a steady assist stage amid rising uncertainty. The present downward momentum has sparked considerations amongst buyers and analysts, with many questioning whether or not Bitcoin has reached its cycle prime. Sentiment available in the market has shifted dramatically, with concern changing the as soon as euphoric optimism that drove the cryptocurrency to latest highs.

Associated Studying

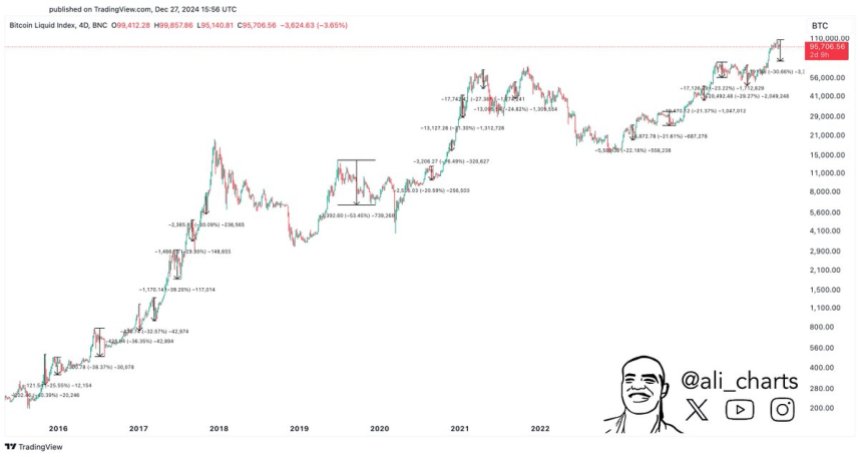

Regardless of the unease, crypto analyst Ali Martinez gives a extra optimistic perspective on the state of affairs. In a latest evaluation shared on X, Martinez prompt {that a} 20% to 30% correction might truly be essentially the most bullish consequence for Bitcoin at this stage. He highlights how such pullbacks have traditionally set the stage for stronger rallies by shaking out weaker palms and permitting the market to reset earlier than resuming its upward trajectory.

As Bitcoin’s value motion teeters on the sting of a possible breakdown, all eyes are on the important thing assist ranges that would decide the following transfer. Will Bitcoin affirm the fears of a cycle prime, or will a wholesome correction present the inspiration for the following leg of its rally? The approaching weeks shall be essential in shaping the narrative for the world’s main cryptocurrency.

Bitcoin Correction Looms

Bitcoin seems on the verge of coming into a vital correction section, with the $92K stage rising as the road within the sand. Analysts and buyers are more and more involved {that a} drop beneath this threshold—and doubtlessly the $90K mark—might set off a wave of promoting strain, driving the worth into sub-$80K territory. The rising concern has forged a shadow over Bitcoin’s bullish narrative as many brace for potential draw back dangers.

Associated Studying

Nonetheless, not everybody sees this potential correction as bearish. Martinez gives a contrarian viewpoint, suggesting {that a} 20% to 30% correction may very well be essentially the most bullish consequence for Bitcoin inside the context of a bull pattern.

Martinez offered a compelling chart showcasing each Bitcoin correction exceeding 20% throughout previous bull markets. His findings reveal that every of those corrections acted as a reset for the market, shaking out weaker palms and paving the way in which for stronger rallies.

Martinez emphasizes that corrections are a pure and wholesome part of Bitcoin’s value cycles, particularly throughout bull runs. By permitting the market to recalibrate, they set the stage for sustained upward momentum. If Bitcoin does expertise a major pullback, it may very well be the precursor to a extra sturdy and extended rally within the coming months.

BTC Testing ‘The Final Line Of Protection’

Bitcoin is presently buying and selling at $94,500, grappling with sustained promoting strain and bearish value motion. The market sentiment has shifted considerably in latest days, with fears of a deeper retracement gaining traction amongst analysts and buyers. Many consider that if Bitcoin loses the $92,000 mark, it might open the door for an accelerated decline.

The $90,000 stage is rising because the vital assist zone that Bitcoin should maintain to keep up its bullish outlook. This stage represents a psychological and technical barrier that would decide the cryptocurrency’s trajectory within the weeks forward. If BTC manages to remain above $90K, analysts anticipate a robust restoration that would reignite bullish momentum and result in a push towards earlier highs.

Associated Studying

Nonetheless, the stakes are excessive. A decisive break beneath the $90,000 stage would possible exacerbate promoting strain, driving Bitcoin into deeper correction territory. In such a state of affairs, costs might fall as little as $75,000, marking a major pullback from latest highs.

Featured picture from Dall-E, chart from TradingView