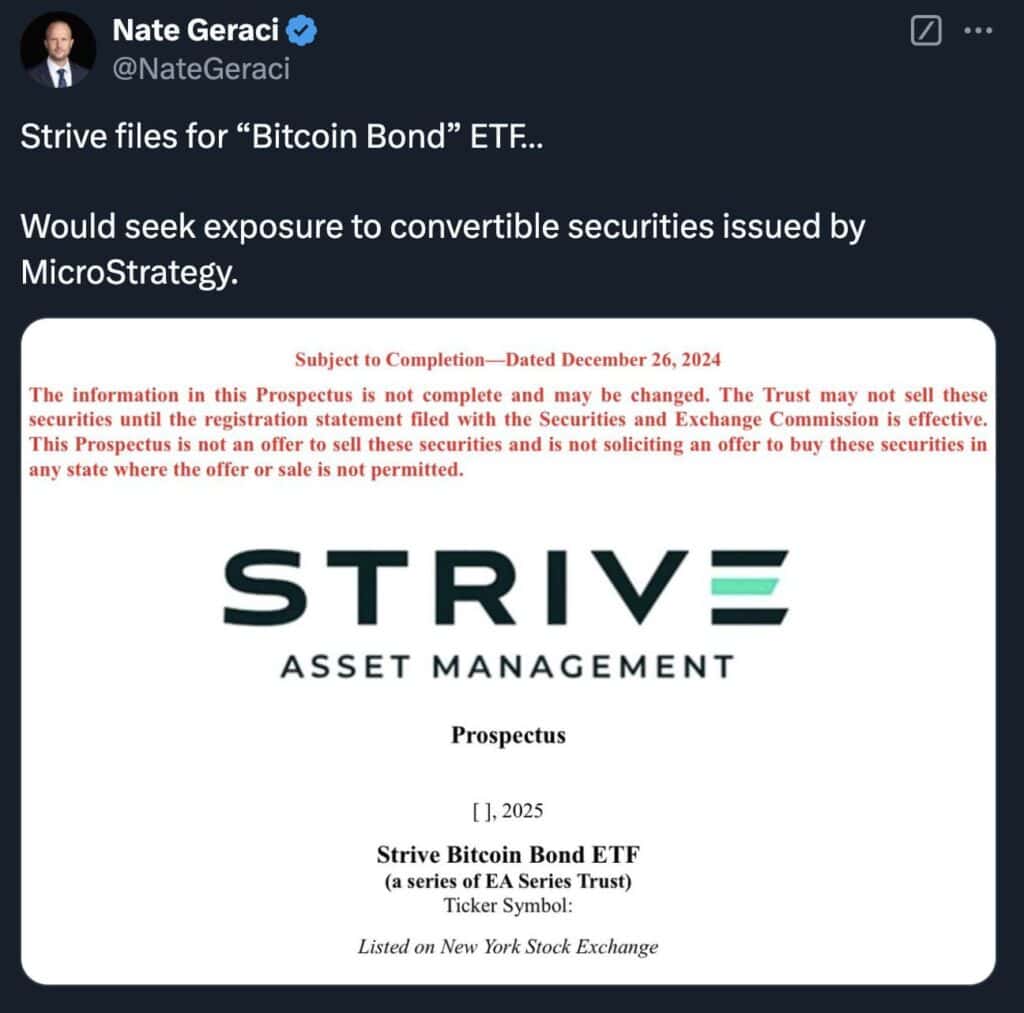

Try Asset Administration, helmed by billionaire entrepreneur and political determine Vivek Ramaswamy, has filed a proposal with the U.S. Securities and Change Fee (SEC) to introduce an exchange-traded fund (ETF) centered on Bitcoin-linked convertible bonds.

This product, the Try Bitcoin Bond ETF, seeks to offer retail and institutional traders simplified entry to monetary devices tied to Bitcoin’s efficiency.

A New Method to Bitcoin Investing

In a December 27 announcement on social platform X, Try Asset Administration shared, “Try’s first of many deliberate Bitcoin options will democratize entry to Bitcoin bonds, bringing these high-potential devices to on a regular basis traders.”

Supply: X

Bitcoin bonds, issued by firms to fund Bitcoin acquisitions, are touted for his or her distinctive risk-return profiles. Nonetheless, such devices stay largely inaccessible to common traders as a result of their complexity and exclusivity. Try’s ETF goals to vary this panorama, providing a streamlined path to investing in Bitcoin-related monetary merchandise.

The ETF will deal with securities from firms like MicroStrategy, a company Bitcoin pioneer. Beneath the management of Government Chairman Michael Saylor, MicroStrategy has bought roughly $27 billion price of Bitcoin since 2020. These acquisitions have been financed utilizing fairness raises and convertible bonds—debt devices that may later be exchanged for fairness below particular phrases.

Supply: X

How the ETF Will Work

In line with the SEC submitting, the Try Bitcoin Bond ETF can be actively managed and search publicity to Bitcoin-linked bonds by way of direct investments or derivatives resembling swaps and choices. To make sure liquidity and collateralization, the fund may even maintain high-quality short-term property like U.S. Treasuries and cash market devices.

Whereas the ETF’s administration charges haven’t been disclosed, actively managed funds usually carry increased expense ratios in comparison with passive ETFs. The added price displays the experience required to navigate the complexities of Bitcoin bonds and associated derivatives.

Try’s Strategic Imaginative and prescient

Based in 2022, Try Asset Administration has positioned itself as a forward-looking funding agency tackling world financial challenges, together with inflation, debt crises, and geopolitical dangers. The agency views Bitcoin as a strategic hedge towards these pressures, describing it as “probably the most compelling long-term funding for danger mitigation.”

Try’s newest ETF initiative aligns with its broader mission to advertise Bitcoin adoption inside diversified portfolios. By simplifying entry to Bitcoin bonds, the agency seeks to encourage each retail and institutional traders to contemplate the cryptocurrency as a foundational element of their monetary methods.

The Larger Image: Ramaswamy’s Management

Ramaswamy, recognized for his capitalist method to problem-solving, has leveraged his platform as a enterprise chief and political determine to advertise revolutionary monetary options. Whereas his 2023 presidential marketing campaign ended with an endorsement of Donald Trump, Ramaswamy’s affect expanded by way of his appointment as co-lead of the Division of Authorities Effectivity (D.O.G.E.), a Trump administration initiative centered on lowering authorities waste, alongside tech mogul Elon Musk.

Try’s Bitcoin Bond ETF represents yet one more step in Ramaswamy’s mission to reshape the monetary and political landscapes, providing traders a singular alternative to interact with the evolving cryptocurrency market.