Hyperliquid is a high-performance Layer 1 blockchain meticulously designed to create a completely on-chain open monetary system. Its imaginative and prescient encompasses user-built functions that work together seamlessly with environment friendly native parts, all whereas making certain an optimum end-user expertise.The Hyperliquid Layer 1 is able to supporting a complete ecosystem of permissionless monetary functions. Transactions, together with orders, cancellations, trades, and liquidations, happen transparently on-chain with a block latency of lower than one second. Presently, the platform can deal with as much as 100,000 orders per second.

Their core product is an modern decentralized trade (DEX) that operates by itself Layer 1 blockchain. It’s designed to merge some great benefits of centralized exchanges with the transparency inherent in decentralized platforms. Hyperliquid primarily facilitates buying and selling in perpetual futures contracts, permitting merchants to invest on cryptocurrency costs with out proudly owning the underlying belongings.

Concerning the Challenge

- Excessive-Efficiency Layer 1 Blockchain: Hyperliquid operates on its proprietary Layer 1 blockchain, particularly designed for high-performance buying and selling. This structure permits for fast transaction processing, reaching a throughput of as much as 200,000 transactions per second and block finality in underneath one second.

- On-Chain Order Ebook: The platform makes use of a completely on-chain order guide mannequin, offering customers with precision and transparency akin to centralized exchanges. This characteristic primarily advantages skilled merchants looking for low latency and excessive accuracy of their trades.

- Perpetual Futures: Hyperliquid makes a speciality of perpetual futures contracts, enabling merchants to invest on cryptocurrency costs with out proudly owning the underlying belongings. The platform presents leverage of as much as 50x on these contracts.

- HyperBFT Consensus Mechanism: On the core of Hyperliquid’s infrastructure is the HyperBFT consensus algorithm, which ensures quick, safe, and clear transactions. This proof-of-stake system enhances the reliability and decentralization of the community.

- Strong Safety Measures: The Layer 1 structure employs a decentralized community of nodes for transaction validation, minimizing dangers related to single factors of failure. Moreover, superior encryption methods safeguard delicate info comparable to transaction data and pockets particulars.

- Decentralized Governance: Hyperliquid incorporates a governance mannequin that enables $HYPE token holders to take part in key choices relating to community upgrades and liquidity administration, fostering group involvement and decentralization

- Robust Group Strategy: Hyperliquid is a community-driven challenge with out enterprise capital backing, which boosts person belief and engagement throughout the ecosystem

Hyperliquid L1

The Hyperliquid structure contains two interconnected chains: the Hyperliquid Layer 1 (L1) and the HyperEVM (EVM). These chains operate as a unified state underneath a typical consensus whereas working as distinct execution environments. The L1 is a permissioned chain that helps native parts, together with perpetual and spot order books and is designed for prime efficiency to facilitate these functionalities. Programmability on the L1 is enabled by way of an API, the place actions submitted have to be signed equally to transactions on an EVM chain.

The HyperEVM is a general-purpose, EVM-compatible chain that enables customers to deploy sensible contracts with out restrictions. This chain presents the additional benefit of accessing on-chain liquidity for perpetual and spot buying and selling from the L1.

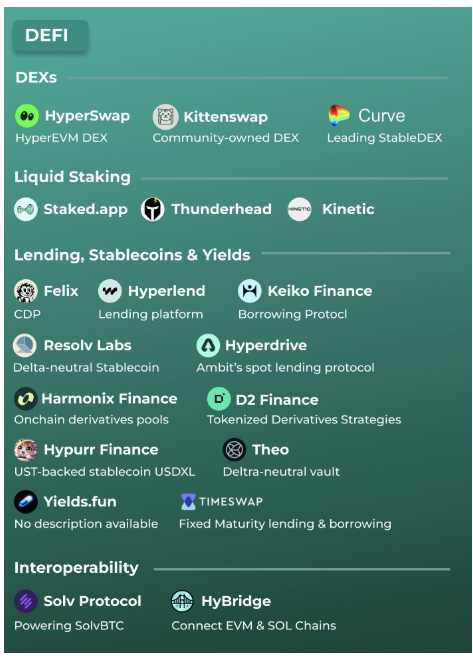

As HyperEVM prepares for launch, quite a few DeFi tasks are gearing as much as deploy concurrently, together with automated market makers (AMMs), lending platforms, liquid staking options, and collateralized debt positions (CDPs). The distinctive traits of on-chain order guide liquidity are anticipated to foster the event of modern functions, positioning Hyperliquid as a most popular platform for rising DeFi-native protocols.

General, Hyperliquid’s dual-chain setup and dedication to excessive efficiency and accessibility are set to redefine the panorama of decentralized buying and selling.

Market Evaluation

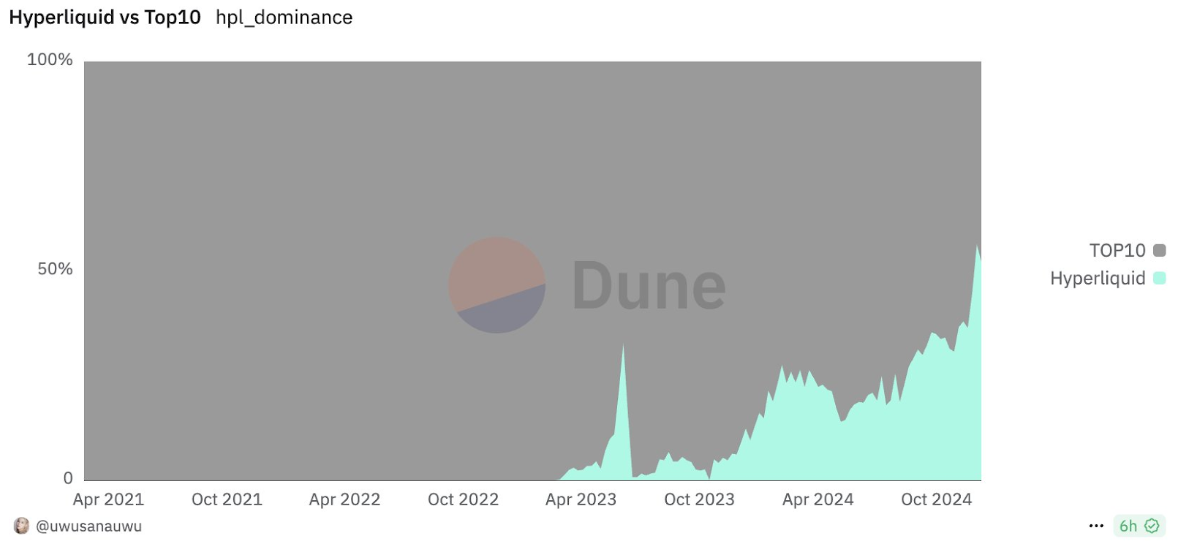

Hyperliquid is quickly turning into a formidable participant within the decentralized trade (DEX) market, significantly in perpetual futures buying and selling. The platform has captured over 50% of the buying and selling quantity on this section, indicating sturdy person engagement and market penetration. As of mid-December 2024, Hyperliquid’s market capitalization has surpassed $10 billion, positioning it among the many high 20 cryptocurrencies, simply behind established gamers like Polkadot. The profitable distribution of 310 million tokens throughout its genesis airdrop, the most important in crypto historical past, has additionally contributed to elevated visibility and person acquisition.

Moreover, Hyperliquid’s distinctive technological developments, comparable to its HyperBFT consensus algorithm and Layer 1 blockchain capabilities, set it other than opponents like Ethereum and Solana. These improvements allow excessive transaction speeds of as much as 200,000 per second, interesting to skilled merchants looking for effectivity and reliability.

The upcoming launch of HyperEVM is anticipated to additional improve Hyperliquid’s ecosystem by attracting a wide range of decentralized finance (DeFi) tasks. This growth is predicted to drive further buying and selling quantity and income streams, solidifying Hyperliquid’s place as a frontrunner within the DeFi area.

Traction

Hyperliquid has established itself as a dominant participant within the decentralized perpetual trade (DEX) market, capturing over 50% of buying and selling quantity previously month. The platform has proven exceptional traction within the cryptocurrency sector, underscored by vital buying and selling volumes and sturdy person engagement. Moreover, Hyperliquid has seen substantial progress in its person base, with over 90,000 early adopters collaborating in its latest genesis airdrop, which distributed 31% of the whole HYPE token provide. As of mid-December 2024, Hyperliquid’s market capitalization stands at roughly $7.22 billion, additional demonstrating its increasing affect throughout the decentralized finance (DeFi) panorama.

Hyperliquid has cultivated a devoted group of over 200,000 customers, with a powerful cumulative buying and selling quantity nearing $450 billion. Presently, the platform boasts an open curiosity exceeding $2.5 billion, reflecting its rising reputation and person engagement within the decentralized finance (DeFi) area. Hyperliquid’s sturdy efficiency is underscored by its latest buying and selling exercise, which has seen vital each day volumes, additional solidifying its place as a number one decentralized perpetual trade. This traction highlights the platform’s attraction and signifies a robust basis for future progress and innovation throughout the cryptocurrency market.

Token

The $HYPE token is integral to the Hyperliquid ecosystem, serving a number of important capabilities that drive the platform’s operations and person engagement. Because the native cryptocurrency, $HYPE grants holders governance rights, permitting them to actively take part in key decision-making processes that form the platform’s future. Moreover, $HYPE facilitates seamless transactions throughout the Hyperliquid community by appearing as the first medium for payment funds.

Furthermore, the token is essential for community safety and person incentivization by way of its staking mechanism. It permits customers to lock their tokens to contribute to community stability whereas incomes rewards in return. The mix of those options not solely enhances person expertise but in addition fosters a robust group across the platform.

General, $HYPE is designed to empower customers, promote lively participation in governance, and guarantee a strong and safe buying and selling setting throughout the Hyperliquid ecosystem.

Token Distribution

Hyperliquid’s tokenomics emphasizes community-driven progress by deliberately avoiding allocations to enterprise capitalists or centralized exchanges. The entire provide of HYPE tokens is capped at 1 billion, with the distribution structured as follows:

- Genesis Distribution (Airdrop): 31%

- Future Emissions & Rewards: 38.888%

- Core Contributors: 23.8%

- Hyper Basis Funds: 6%

- Group Grants: 0.3%

Moreover, group tokens are locked for one 12 months, adopted by a gradual month-to-month unlock over two years. This strategy ensures a balanced distribution whereas selling long-term dedication from the core group and contributors. Hyperliquid’s deal with a decentralized and community-oriented mannequin is designed to foster sustainable progress and engagement inside its ecosystem.

The Hyperliquid Airdrop

On November 29, 2024, Hyperliquid executed one among cryptocurrency’s largest and most beneficiant airdrops. This Genesis airdrop distributed 31% of the whole $HYPE provide to over 90,000 early adopters and customers of the platform. The initiative rewarded loyal group members and established a brand new benchmark for equity and inclusivity throughout the crypto area.

Enterprise Mannequin and Income

Hyperliquid employs a simple but efficient income mannequin based on platform charges and token auctions. The platform generated roughly $26.5 million in USDC previously month, with $2 million derived from token auctions and a powerful $24.5 million from platform charges. This substantial income positions Hyperliquid simply behind main gamers like Ethereum and Solana in annualized income, indicating its rising prominence within the decentralized finance (DeFi) sector.

Traders

Hyperliquid has adopted a singular funding mannequin by remaining fully self-funded and never allocating any of its token provide to personal buyers or exchanges. This strategy ensures that possession and governance stay with the group of customers slightly than exterior buyers, which is a particular characteristic within the present crypto panorama. the challenge has garnered vital consideration and participation from the group, significantly throughout its latest HYPE token airdrop, which distributed 31% of the whole provide to early customers. This technique rewards loyal contributors and fosters a robust community-driven ecosystem.

Staff

Hyperliquid Labs is a key contributor to Hyperliquid’s growth and progress. It’s led by co-founders Jeff Yan and Iliensinc, who’re Harvard alumni. The group contains members from prestigious establishments comparable to Caltech and MIT, with skilled backgrounds at notable firms, together with Airtable, Citadel, Hudson River Buying and selling, and Nuro.

Conclusion

Hyperliquid represents a big development within the decentralized finance (DeFi) panorama, combining the pace and effectivity of centralized exchanges with the transparency and safety of blockchain know-how. This modern platform has established itself as a revolutionary drive within the cryptocurrency area, with success measured by its complete ecosystem slightly than simply token costs or buying and selling volumes. Latest additions, comparable to Ethereum Digital Machine (EVM) compatibility and staking capabilities on the testnet, spotlight Hyperliquid’s dedication to ongoing innovation. What units Hyperliquid aside is its community-first ethos. By remaining self-funded and avoiding enterprise capital affect, the group is targeted on constructing a platform that genuinely serves person wants. As these components come collectively, Hyperliquid is poised to rework on-chain transactions, actively redefining the requirements for decentralized buying and selling platforms.

| Elementary Rating | |||||

| Max rating | Choices | Rating | |||

| Downside | 10 | Average, considerably persistent drawback | 7 | ||

| Answer | 10 | Distinct, defensible resolution | 9 | ||

| Market Dimension | 10 | Giant market, vital progress potential | 8.5 | ||

| Rivals | 10 | Excessive competitors, however room for differentiation | 7 | ||

| Use case | 10 | Broad use case with community results | 10 | ||

| Present Traction | 10 | Excessive traction, sturdy person progress and retention | 10 | ||

| Unit Economics | 5 | Optimistic unit economics, with plans for additional enchancment | 3 | ||

| Tokenomics | 10 | Strong token technique, aligns with person incentives | 8.5 | ||

| Product Roadmap | 5 | Unclear or unrealistic product roadmap | 1 | ||

| Enterprise Mannequin | 10 | Confirmed enterprise mannequin with clear path to profitability | 9 | ||

| Go-to-Market Technique | 5 | Strong GTM technique, clear goal market and channels | 4 | ||

| Group | 5 | Huge, sturdy and lively group | 5 | ||

| Regulatory Dangers | 5 | Minimal regulatory danger, sturdy mitigation and flexibility | 5 | ||

| Whole Rating | 82.86% | ||||