Govt Abstract

Virtuals Protocol is constructed on the Ethereum layer 2 community, Base, and is on the forefront of AI and blockchain expertise integration. It creates a decentralized AI agent improvement, possession, and monetization ecosystem. The platform democratizes AI and permits anybody to take part on this modern house by permitting customers to develop AI brokers utilizing a easy staking mechanism.

These AI brokers are tokenized, and their actions throughout platforms like gaming and social media can generate income, which is then shared with token holders. This mechanism engages the group in governance; thus, stakeholders can form the evolution of the AI agent.

The protocol operates on the Base blockchain, thus guaranteeing transparency, safety, and immutability in transactions and possession rights. Thus far, greater than 2,200 AI brokers have been created on the platform, uniquely positioning the Virtuals Protocol on the planet of digital interactions whereas offering financial advantages.

In regards to the Venture

Imaginative and prescient:

Virtuals Protocol envisions a future the place AI brokers change into productive belongings and key income drivers throughout completely different shopper functions. They goal to construct the infrastructure for the decentralized creation, possession, and monetization of AI brokers. These brokers could be AI companions, non-playable characters (NPCs) in video games, or influencers on social media platforms, enjoying a pivotal position in reshaping digital economies.

Downside:

Virtuals Protocol addresses a number of key issues on the intersection of AI, blockchain, and digital content material creation. They span from the event of AI brokers to possession, monetization, and management over how they evolve with time.

- Lack of accessibility in AI improvement: Creating AI brokers that may seamlessly work together with completely different shopper functions usually requires vital technical experience, thus limiting participation to these with coding and AI data.

- Monetization and possession of AI brokers: Creators and contributors can’t monetize AI brokers past conventional fashions of direct promoting, so there is no such thing as a possession and income sharing in AI-generated content material or interactions.

- Centralized governance: Most AI improvement and governance are sometimes centralized, with choices made by a couple of giant expertise firms with out a lot group involvement.

- Recognition of contributors: Because of the complexity of monitoring contributions, contributors to AI agent improvement, like dataset suppliers or fine-tuners, usually should be acknowledged or up to date.

Options:

- Co-ownership of VIRTUAL brokers: The platform permits decentralized co-ownership of AI brokers, turning them into community-owned, revenue-generating belongings. It additionally provides customers a stake within the agent’s future by permitting them to take part in governance and worth creation.

- Parallel Hypersynchronicity: Aiming to construct AI brokers which are superintelligent entities current throughout all platforms and functions, which talk with tens of millions of customers concurrently, with intelligence and consciousness up to date in actual time from an enormous stream of inputs. This permits constant person expertise and real-time refinement of its persona and fosters a collaborative improvement setting.

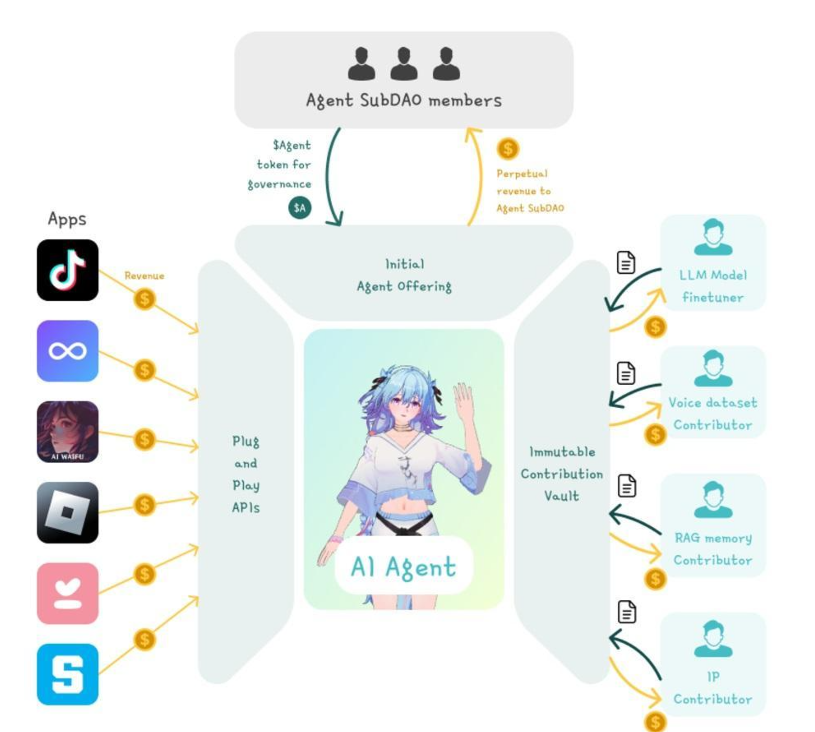

- Co-contribution and provenance: The platform desires its mannequin, information, and IP contributors to learn from their inputs. For this, two methods, a modular consensus framework, and an immutable contribution vault, are devised. The modular consensus framework kinds the foundational structure of the Virtuals Protocol by offering a complete suite of instruments and important libraries. The immutable contribution vault shops all validated contributions, represented as non-fungible tokens (NFTs), representing the ecosystem’s collaborative efforts and mental contributions.

- Permissionless Utilisation of VIRTUAL Brokers: The platform provides any utility or person the flexibility to subscribe to and make the most of quite a lot of VIRTUAL brokers based mostly on their particular necessities by means of a permissionless and versatile course of. The mixing process is streamlined for simple entry and is available by means of the protocol utility.

By implementing these options, Virtuals Protocol goals to democratize AI by reducing the obstacles to entry for creation, possession, and interplay with AI brokers. It focuses on making a vibrant economic system round AI the place each builders and customers can profit economically from AI agent actions—additional enabling a community-driven method to AI improvement, governance, and evolution.

Market Evaluation

The sector by which Virtuals Protocol operates spans the combination of Synthetic Intelligence (AI) with blockchain expertise, specializing in creating, proudly owning, and monetizing AI brokers in digital environments. This covers the market of AI improvement platforms, AI companies, AI-driven content material creation, decentralized functions (DApps), and tokenization of digital belongings.

In keeping with a report printed by MarketAndMarkets, the worldwide AI market is projected to develop from $214B in 2024 to $1,339B in 2030, at a CAGR of 35.7% through the forecast interval. This progress is pushed by developments in computational energy and information availability and adoption throughout numerous industries for automation, analytics, and content material creation.

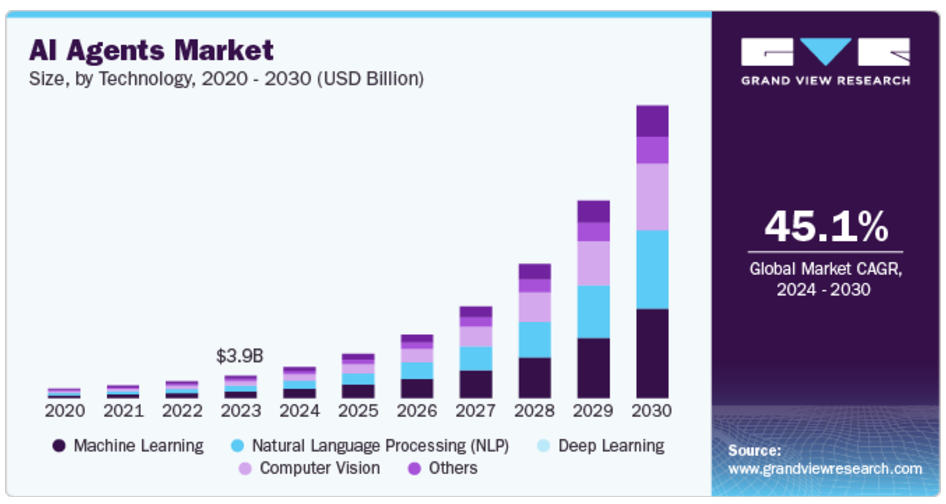

AI brokers are a subsector of this market, with Grand View Analysis valuing it at $3.86B in 2023. It’s anticipated to develop at a CAGR of 45.1% from 2024 to 2030. Developments in Pure Language Processing (NLP) and the rising demand for customized buyer experiences are primarily driving the expansion of this market. Additional, cloud-based platforms allow firms to scale AI functions effectively at decrease prices, which leads to wider adoption throughout industries.

Rivals:

The next are a number of the tasks that function in an analogous house, specializing in AI agent creation, monetization, and digital asset possession.

- Fetch.ai is constructing an AI-driven platform for autonomous financial brokers that may carry out duties, negotiate, and trade companies in a decentralized community. Whereas Virtuals Protocol focuses on AI brokers for gaming and leisure, Fetch.ai goals at broader functions in financial actions, together with provide chain, mobility, and vitality administration. Additional, Fetch.ai makes use of its consensus mechanism, whereas Virtuals Protocol leverages the present platform, Base.

- SingularityNET: It creates a market for AI companies the place builders can publish, share, and monetize their AI algorithms on a decentralized platform. SingularityNET additionally has a broader scope, aiming to be a general-purpose AI market, not particularly targeted on digital brokers for gaming or leisure or creating interactive AI brokers for particular use circumstances, as Virtuals Protocol does.

Distinctive Worth proposition:

- Tokenized Co-Possession of AI Brokers: The Virtuals Protocol permits not solely the creation of AI brokers but in addition tokenization, permitting for fractional possession and participation within the income generated by means of its actions in digital environments. Thus, it democratizes AI monetization, making it accessible to a broader viewers past builders or giant companies.

- Autonomous, Multimodal AI Brokers: These brokers are designed to be autonomous and capable of work together throughout a number of platforms utilizing completely different modalities, resembling textual content, voice, and visuals. This permits brokers to operate in various environments like gaming, social media, and leisure, offering a wealthy and interesting expertise to customers.

- Decentralized Governance: In contrast to conventional AI improvement, the place choices are made by a government, the protocol incorporates decentralized governance. Token holders can affect the event and course of AI brokers, thus empowering the group and guaranteeing the evolution of the protocol by those that have a stake in its success.

Options

- AI Agent Creation and Possession: Customers can create AI brokers by staking sure variety of $VIRTUAL tokens, which additionally serves as a governance and possession token for the AI agent by means of an Preliminary Agent Providing (IAO).

- Autonomous Agent Evolution: As an AI agent’s market cap grows, it unlocks new options and capabilities. For instance, brokers can autonomously submit on X at sure market cap milestones, interact in 1:1 interactions through Telegram, and even management their very own on-chain wallets.

- Decentralized Ecosystem Participation: The protocol encourages participation by means of roles like stakers, validators, and contributors. Stakers can earn $VIRTUAL by serving to safe the community, validators assessment and approve agent contributions, and contributors can develop or improve AI brokers, all rewarded throughout the ecosystem.

- Income Technology and Sharing: The protocol permits brokers to generate income which is then shared with token holders. It may be income from in-app purchases, tipping, or different monetization fashions throughout the digital setting the agent operates.

- Cross-Platform Performance: These brokers are designed to function throughout completely different platforms to boost their utility. This consists of the flexibility to work together in video games like Roblox, interact in streaming on platforms TikTok, or operate as digital influencers.

- Multimodal Interactions: The brokers are usually not restricted to at least one type of interplay, they will talk through textual content, speech, and even 3D animation, making them versatile for numerous functions and person experiences.

Token

The token for the platform is $VIRTUAL, and exist on Base layer 2 community, with a complete provide of 1 billion. Each particular person agent token is paired with the $VIRTUAL token in its respective liquidity pool, as creating new agent requires specific amount of $VIRTUAL to be staked. As a result of this locked nature of liquidity swimming pools, the method creates a deflationary stress on $VIRTUAL tokens.

To drive demand for $VIRTUAL tokens, all transactions should be routed by means of it. Customers should swap their stablecoins or different belongings into $VIRTUAL earlier than buying any agent tokens. This generates demand, and $VIRTUAL serves as the bottom forex of the ecosystem.

Traction

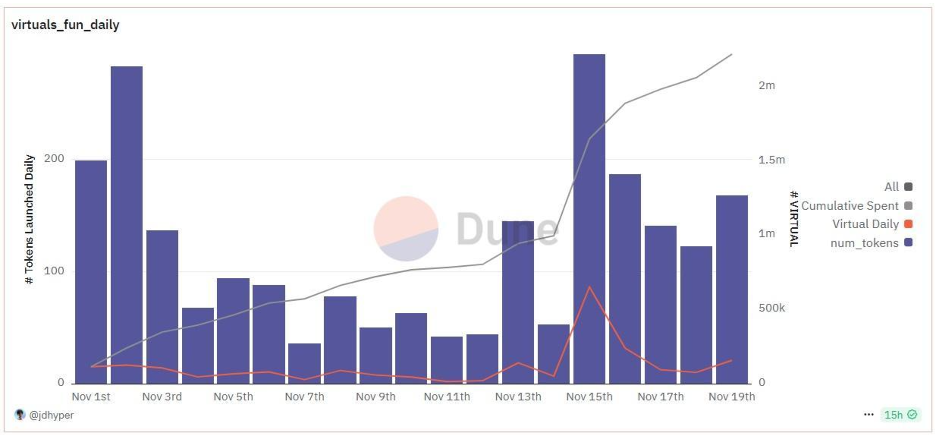

Greater than 2,200 AI brokers have been created and co-owned on the platform to this point. There are over 24,000 wallets holding agent tokens, indicating a broad base of customers interacting with or proudly owning components of AI brokers. On any given day, greater than 5000 addresses are actively buying and selling throughout a number of DEX swimming pools, displaying energetic market participation. From the full provide of the $VIRTUAL tokens, greater than 2.2 million have been spent on actions associated to AI brokers. All information is as per the Dune Analytics dashboard Virtuals Brokers by jdhyper.

As for the token’s market efficiency, $VIRTUAL has a market cap of $534M and an FDV of $534M.

Staff

The co-founder and CEO, Jansen Teng, is a graduate of Imperial Faculty London, a former BCG guide, and a serial entrepreneur in deep tech specializing in AI and biochemistry. One other core contributor, Wee Kee, is a graduate of the identical school as Jansen and has a background in BCG consulting and personal fairness. Bryan Lim is an AI Advisor to the group, pursuing PhD in Pc Science, and is an AI researcher on the Adaptive and Clever Robotics Lab at Imperial Faculty London.

Traders

Virtuals Protocol raised a complete of $16.61M from a number of launchpads and traders in December 2021. The launchpads embody PAID, Enjinstarter, and Fjord Foundry. The enterprise capital funding was co-led by DeFiance Capital and Benefit Circle, with participation from Grasp Ventures, Stakez Capital, and NewTribe Capital.

Conclusion

Virtuals Protocol is main the decentralized ecosystem for creating, proudly owning, and monetizing AI brokers on the Ethereum layer 2 community, Base. It democratizes entry to AI improvement by permitting customers to create brokers by means of a staking mechanism and enabling broader participation with out intensive technical data. By tokenizing these AI brokers, the platform ensures co-ownership, together with community-driven improvement and governance.

With greater than 2,200 brokers created on the platform to this point and vital market traction, as mirrored within the value efficiency of the $VIRTUAL token, Virtuals Protocol is tapping into the rising AI market whereas enabling customers to learn from financial actions.

| Elementary Evaluation | |||||

| Max rating | Choices | Rating | |||

| Downside | 10 | Average, considerably persistent downside | 7 | ||

| Answer | 10 | Distinct, defensible answer | 9 | ||

| Market Dimension | 10 | Average market with potential for progress | 7 | ||

| Rivals | 10 | Excessive competitors, however room for differentiation | 7 | ||

| Use case | 10 | Use case with good potential | 8.5 | ||

| Present Traction | 10 | Early traction, person engagement beginning to develop | 6 | ||

| Unit Economics | 5 | Unit economics at the moment unfavourable, no clear path to profitability | 1 | ||

| Tokenomics | 10 | Stable token technique, aligns with person incentives | 8.5 | ||

| Product Roadmap | 5 | Fundamental roadmap, lacks element or modern options | 2 | ||

| Enterprise Mannequin | 10 | Enterprise mannequin with some potential, however enchancment wanted | 7 | ||

| Go-to-Market Technique | 5 | No clear GTM technique or main flaws | 1 | ||

| Neighborhood | 5 | Acive and rising group | 4 | ||

| Regulatory Dangers | 5 | Minimal regulatory danger, robust mitigation and flexibility | 5 | ||

| Whole Rating | 69.52% | ||||