Ethereum (ETH) demand is basically pushed by the token’s use in on-chain functions and token transfers, in keeping with a report by CoinShares.

Ethereum’s Use-Circumstances Have Elevated, However Lengthy-Time period Worth Is Lacking

In a lately revealed detailed report, CoinShares’ Matthew Kimmell famous that regardless of Ethereum’s potential to host fashionable functions sooner or later, traders are struggling to see a major worth proposition in its native ETH token.

Associated Studying

Since its inception in July 2015, Ethereum has made large strides because it has frequently witnessed the emergence of latest use-cases, ranging from easy token transfers, to make use of in on-chain functions, decentralized finance (DeFi) protocols, and, most lately, non-fungible tokens (NFTs).

Based on the report, Ethereum started to see broader utility from 2018 onwards, when its main use shifted from token transfers to easy on-chain functions, digital id methods, and on-chain withdrawals.

From 2020 onwards, Ethereum has facilitated extra complicated use-cases similar to protocol staking, liquidity mining, MEV (most extractable worth), bridges, oracles, and second-layer applied sciences. Though the rising use-cases would possibly sound favorable for Ethereum on the floor degree, the problem lies in ETH utilization being concentrated amongst a restricted vary of companies.

The report reads:

Nonetheless, the arduous fact is {that a} very small set of companies persistently makes up the vast majority of Ethereum utilization, and these units largely revolve round hypothesis or easy worth switch, not essentially the kind of complicated “real-world utility” use instances initially envisioned by the builders of the Ethereum Basis.

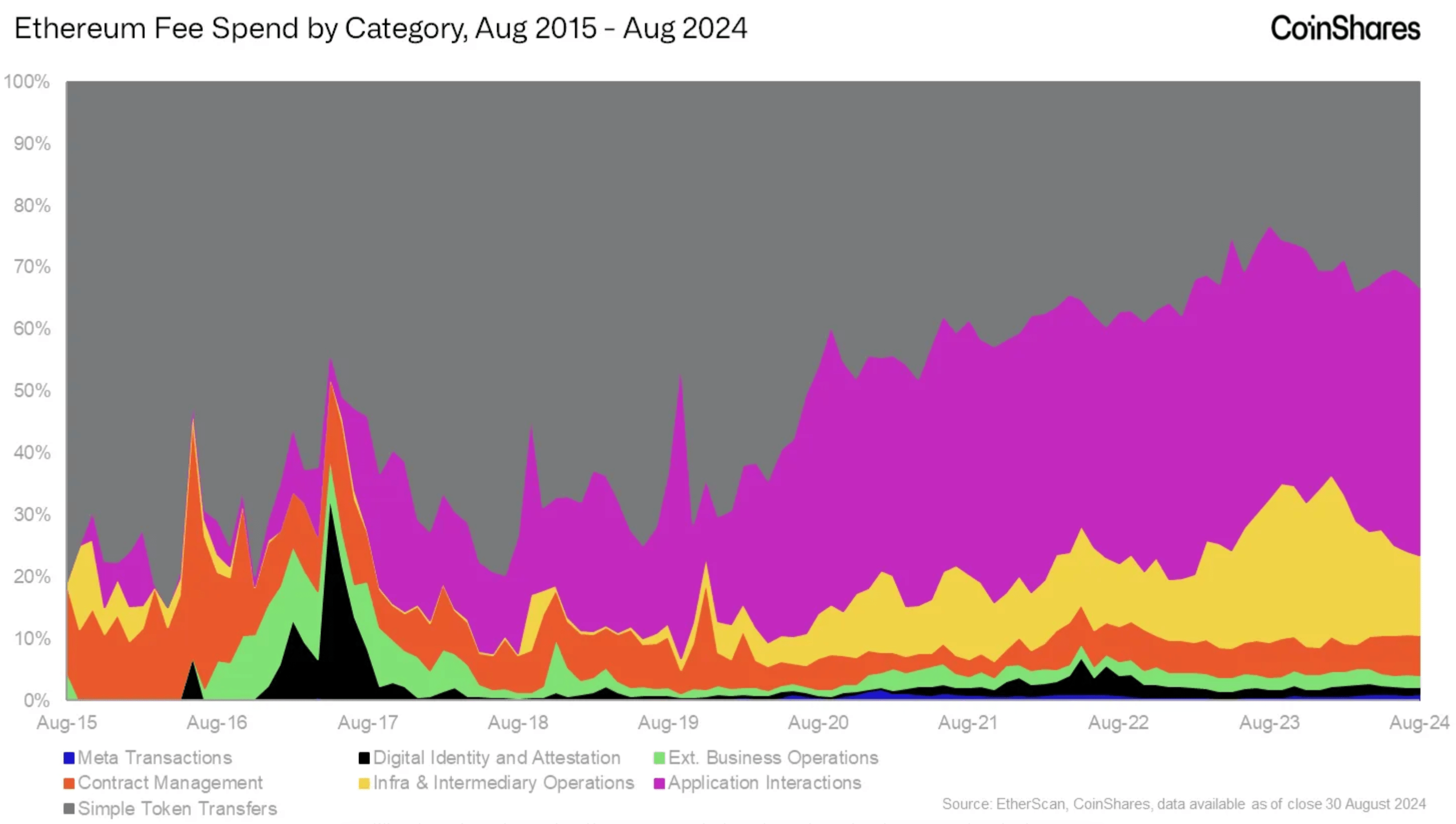

The chart under confirms this remark, exhibiting that easy token transfers and utility interactions comprise the majority of ETH utilization, adopted by infrastructure, middleman operations, and contract administration.

Marketplaces Dominate Utility Utilization, Stablecoins Lead Token Transfers

The report highlights that on-chain marketplaces – particularly decentralized exchanges (DEXes) like Uniswap – dominate utility interactions. Notably, over 90% of transaction charges originate from market exercise.

Within the first half of 2024, Uniswap alone captured about 15% of Ethereum transaction charges. This isn’t stunning, because the main DEX lately achieved the milestone of producing $50 million in income. Quite the opposite, NFT buying and selling platforms have suffered a dramatic decline in person transactions since their peak in 2021.

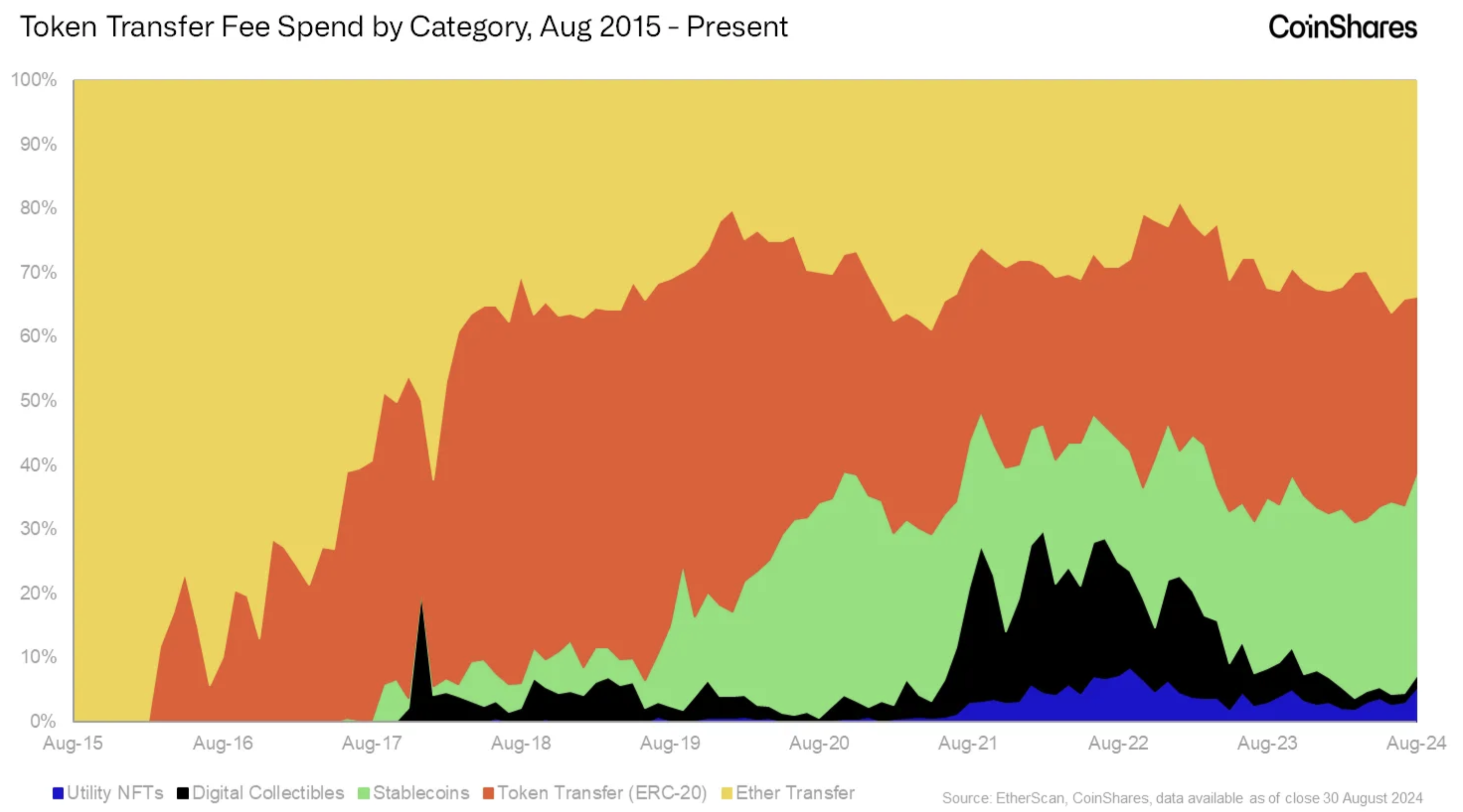

Token transfers proceed to play a key function within the Ethereum community exercise. With the continuously increasing ecosystem, the kind of tokens being transferred has diversified. Nonetheless, ETH, and stablecoins similar to USDT and USDC have emerged because the dominant tokens by way of transaction charges.

The chart under illustrates the rise of stablecoins from mid-2017, when USDT started to see excessive adoption as a buying and selling pair for nearly all listed ERC-20 tokens on crypto exchanges. Circle’s entry into the market in late 2020 with its USDC stablecoin additional boosted stablecoin utilization inside the wider Ethereum ecosystem.

An attention-grabbing remark made within the report is relating to the elevated use of Ethereum layer-2 options. Whereas their adoption has tackled a few of Ethereum’s scalability points, they’ve additionally, unintentionally diminished demand for Ethereum’s base layer. Kimmel notes:

In our view, the newest main change, EIP-4844, which strongly incentivized Layer 2s, has labored instantly in opposition to the financial design advantages of EIP-1559, which tied the worth of ether to its Layer 1 platform demand.

Associated Studying

ETH trades at $2,613 at press time, up 0.2% within the final 24-hour interval. Stablecoins similar to USDT and USDC command a market cap of $119 billion and $36 billion, respectively.

Featured picture from Unsplash, Charts from CoinShares.com and Tradingview.com