MicroStrategy acquired roughly 18,300 Bitcoin for $1.1 billion between Aug. 6 and Sept. 12 at a mean value of $60,408 per BTC, in response to a Sept. 13 submitting with the US Securities and Change Fee (SEC).

Coinflip information reveals the corporate’s newest buy already has a paper lack of $2.2 million as a result of prime digital asset’s present volatility.

Funding

The agency acknowledged that the acquisition was funded by promoting greater than 8 million firm shares through a gross sales settlement with a number of monetary establishments, together with TD Securities, The Benchmark Firm, BTIG, Canaccord Genuity, Maxim Group, and SG Americas Securities.

The capital raised from these gross sales was straight used to develop its Bitcoin holdings.

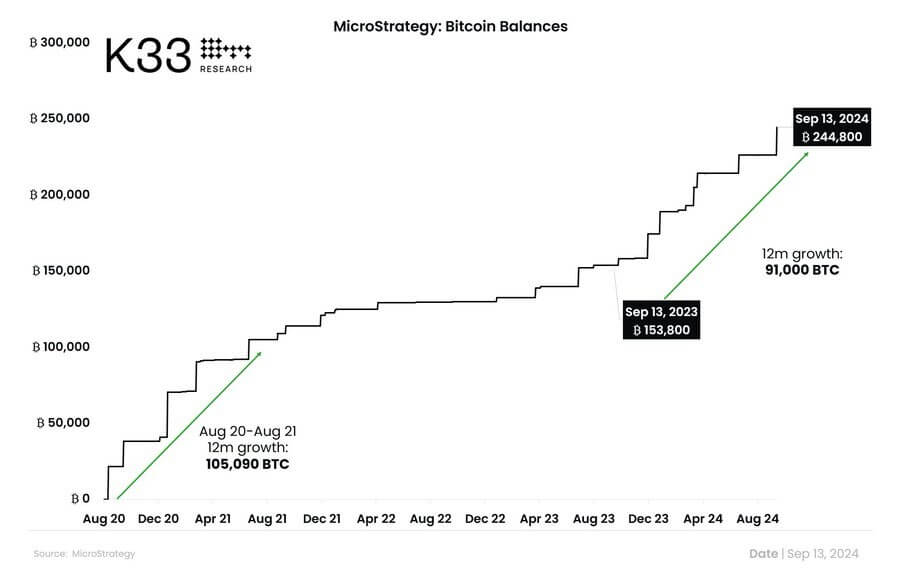

Notably, the agency has pursued this funding technique aggressively through the previous yr to accumulate the highest digital asset. K33 Analysis acknowledged that the agency has purchased round 91,000 BTC between Sept. 2023 and in the present day.

It added:

“August 2020-21 is the one interval that includes the next YoY development in MSTR’s BTC publicity of 105,090 BTC.”

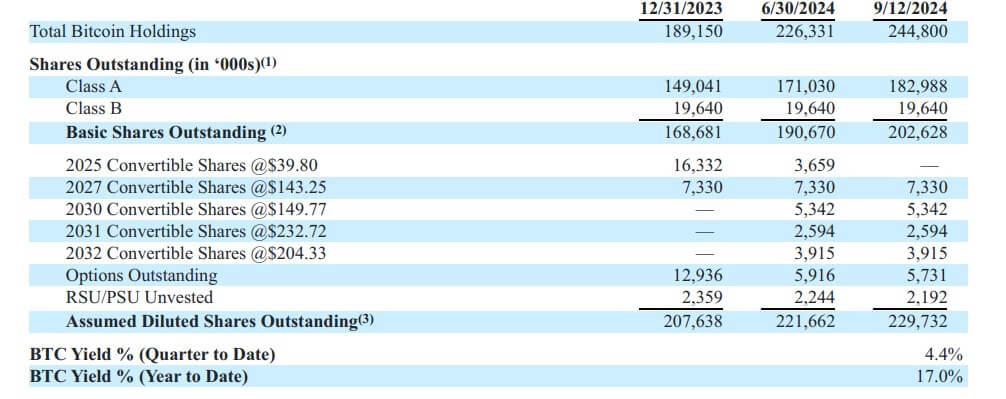

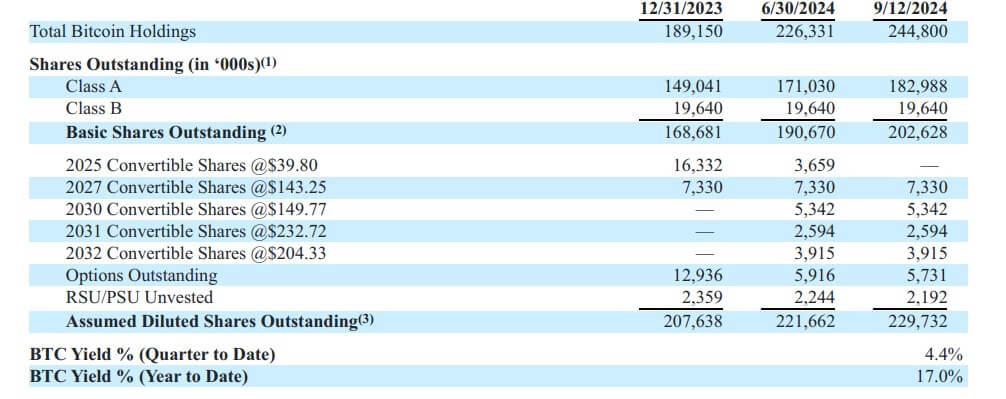

In the meantime, this newest acquisition introduced MicroStrategy’s whole Bitcoin holdings to 244,800 BTC, valued at over $14 billion at present costs. The corporate’s whole funding in Bitcoin is $9.45 billion, with a mean buy value of $38,585 per Bitcoin.

Saylortracker information signifies the agency holds an unrealized revenue of greater than $4 billion.

Bitcoin yield

MicroStrategy Government Chairman Michael Saylor reported a Bitcoin yield of 4.4% for this quarter and 17% year-to-date on its holdings.

In keeping with the SEC submitting, this key efficiency indicator (KPI) helps assess the agency’s technique for buying Bitcoin. The BTC yield metric tracks the share change over time within the ratio of MicroStrategy Bitcoin holdings to diluted shares.

The corporate believes this measure can improve buyers’ understanding of its determination to fund Bitcoin purchases by means of issuing further shares or convertible devices.

Regardless of information of the newest buy, MicroStrategy’s shares stay flat in premarket buying and selling. Nonetheless, it has risen 91% year-to-date.