7 Early Warning Indicators a Crypto Bear Market is Coming

Within the risky world of cryptocurrency, bull runs create millionaires, however bear markets may be devastating for the unprepared. Whereas nobody can predict the long run with excellent accuracy, there are a number of dependable indicators and bearish crypto traits that may sign an impending crypto market crash. Understanding these early warning indicators may be the distinction between preserving your capital and watching it disappear. This information will stroll you thru the seven most important indicators of a crypto bear market, empowering you to make smarter, extra strategic choices.

What Precisely is a Crypto Bear Market?

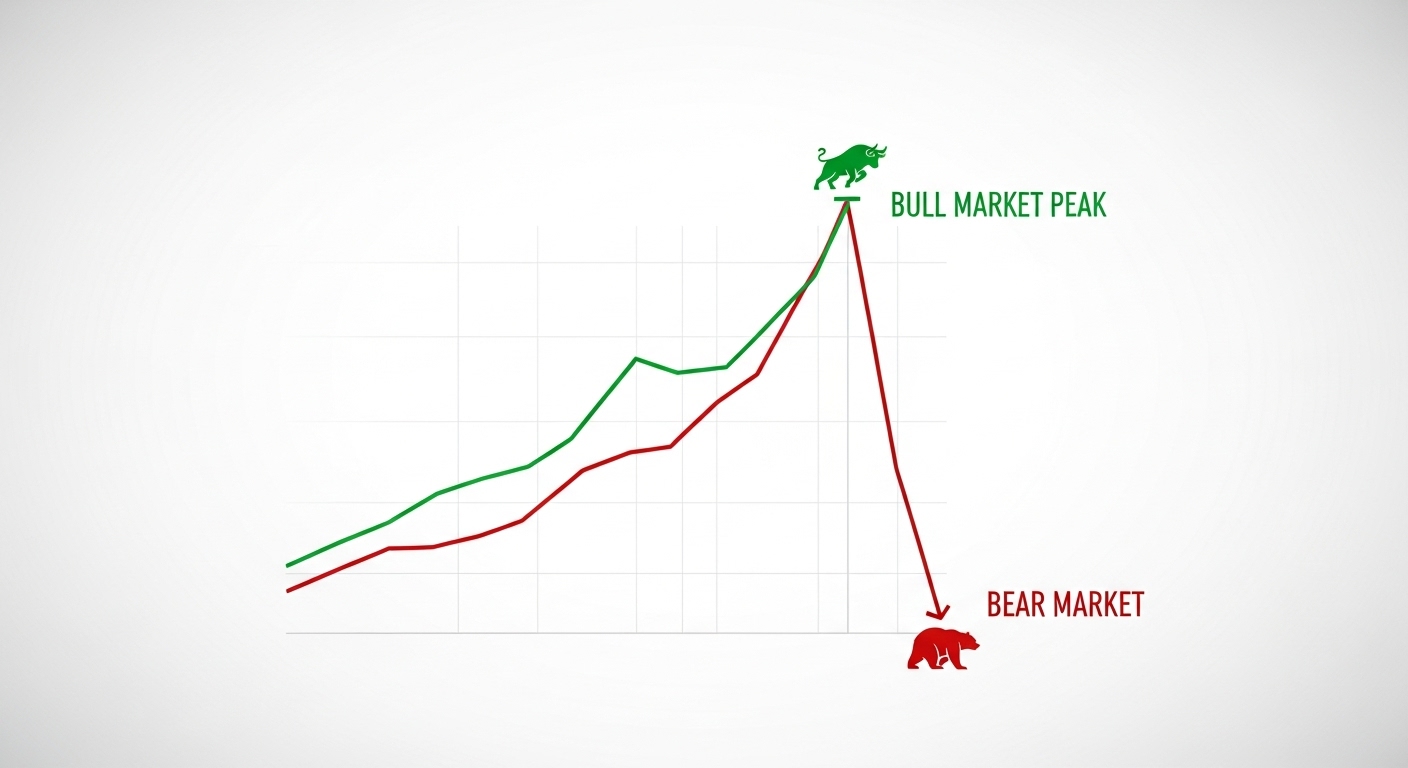

Earlier than we dive into the indicators, let’s make clear what we imply. A crypto bear market is a protracted interval of declining costs, sometimes characterised by a drop of 20% or extra from latest highs amidst widespread pessimism and detrimental investor sentiment. In contrast to a short-term correction, a bear market can final for months and even years, shaking out speculative buyers and testing the conviction of long-term holders. Studying how you can establish a crypto bear market early is a vital ability.

Methods to Predict a Crypto Bear Market: 7 Key Indicators

Staying vigilant and goal is essential. When market sentiment is overwhelmingly optimistic, it may be laborious to see the storm clouds gathering. Listed below are the crypto market crash indicators you need to be watching.

1. Excessive Public Euphoria and Mainstream Hype

One of the traditional indicators of a market high is when everyone seems to be speaking about crypto. When your pals, household, and colleagues who’ve by no means invested earlier than begin asking how you can purchase the most recent meme coin, it’s a sign that speculative frenzy has peaked. This stage is usually marked by sensationalist information headlines, movie star endorsements, and a pervasive ‘this time it is completely different’ mentality. That is typically when skilled buyers start to take income, anticipating that there are few new consumers left to enter the market.

2. Altcoin Season Fizzles Out

A typical bull cycle sees capital rotate from Bitcoin to large-cap altcoins (like Ethereum) after which to smaller, riskier altcoins. This last stage, referred to as ‘altcoin season,’ is the place explosive, typically unsustainable positive aspects happen. An early warning signal of a crypto bear market is when this pattern reverses. In the event you see high altcoins failing to set new highs or bleeding worth towards Bitcoin, it signifies that speculative capital is exiting the market. The cash is flowing again to the relative security of Bitcoin or out of crypto fully.

3. Destructive Shifts in Macroeconomic Circumstances

Cryptocurrency doesn’t exist in a vacuum. It’s closely influenced by the broader international economic system. Key bearish indicators embody central banks elevating rates of interest to fight inflation, tightening financial insurance policies, or a looming recession. In such environments, buyers are inclined to de-risk their portfolios, promoting off speculative property like crypto in favor of safer havens like bonds or money. At all times take note of central financial institution bulletins, as alerts that FOMC charge cuts loom can dramatically shift investor sentiment and capital flows.

4. Heightened Regulatory Scrutiny

Governments and regulatory our bodies worldwide are nonetheless determining how you can deal with cryptocurrencies. A sudden wave of detrimental regulatory information, akin to a significant nation banning crypto buying and selling, the SEC launching lawsuits towards distinguished initiatives, or the implementation of new FSA stablecoin tips, can create immense concern and uncertainty. This ‘FUD’ is usually a main catalyst that pushes a correcting market right into a full-blown bear pattern.

5. Bearish On-Chain Metrics

On-chain evaluation gives a clear take a look at the exercise on a blockchain. A number of metrics can function early warning indicators. For instance, a sustained improve within the quantity of Bitcoin or Ethereum being despatched to exchanges means that long-term holders are getting ready to promote. One other indicator is a decline within the variety of lively pockets addresses, signaling waning consumer engagement. Instruments that monitor these flows can present an goal view, indifferent from market hype.

6. Technical Evaluation Reveals Weak point

Whereas not foolproof, technical evaluation can reveal indicators of a weakening pattern. One of the well-known bearish alerts is the ‘demise cross,’ which happens when a short-term shifting common (just like the 50-day) crosses beneath a long-term shifting common (just like the 200-day). Anticipating main chart occasions, like a BTC 50-week EMA breakout or breakdown, gives historic context on potential market shifts. Different indicators embody a failure to interrupt above earlier resistance ranges, declining buying and selling quantity on value will increase, and bearish divergence on indicators just like the Relative Energy Index (RSI).

7. The ‘Sensible Cash’ Goes Silent

Outstanding enterprise capitalists, crypto founders, and influential analysts who have been as soon as extraordinarily bullish typically turn into noticeably quiet or begin issuing cautious warnings because the market nears a high. They could cease tweeting day by day value targets or start emphasizing the significance of threat administration. When essentially the most knowledgeable gamers within the house begin to hedge their bets, it is clever to concentrate. It is a refined however highly effective signal of an impending crypto market crash.

Conclusion: Keep Ready, Not Scared

Recognizing the indicators of a crypto bear market is not about timing the highest completely—it is about managing threat. By awaiting these seven early warning indicators, you possibly can shift from a purely speculative mindset to a extra defensive and strategic one. Whether or not you determine to take some income, hedge your positions, or just put together mentally for a downturn, being knowledgeable is your best asset in navigating the inevitable cycles of the crypto market.