After a number of weeks of sustained upward momentum, Bitcoin is presently holding above $66,000. The value has just lately encountered resistance on the essential $69,000 stage, which is predicted to take time and important liquidity to beat.

Key information from Binance reveals that greater than half of futures merchants have shorted BTC prior to now few hours, making a divisive surroundings for value motion.

Associated Studying

The futures market typically serves as a barometer for momentum and liquidity, signaling potential shifts in Bitcoin’s value motion. As BTC consolidates just under the $69,000 resistance, sustaining help above $66,000, the approaching days might be pivotal.

Buyers and analysts are intently watching to find out whether or not Bitcoin will break by means of to new all-time highs or if the buildup interval will proceed. The end result may set the tone for the subsequent section of the market.

Bitcoin Future Merchants Stay Bearish (For Now)

Bitcoin is presently in a consolidation section after weeks of spectacular value appreciation. Regardless of this pause, analysts and traders stay optimistic about Bitcoin’s value trajectory within the coming weeks, with many believing that BTC will start a large rally as soon as it breaks its all-time highs. Nevertheless, this breakout could take a while, as key information from Binance signifies bearish sentiment amongst futures merchants.

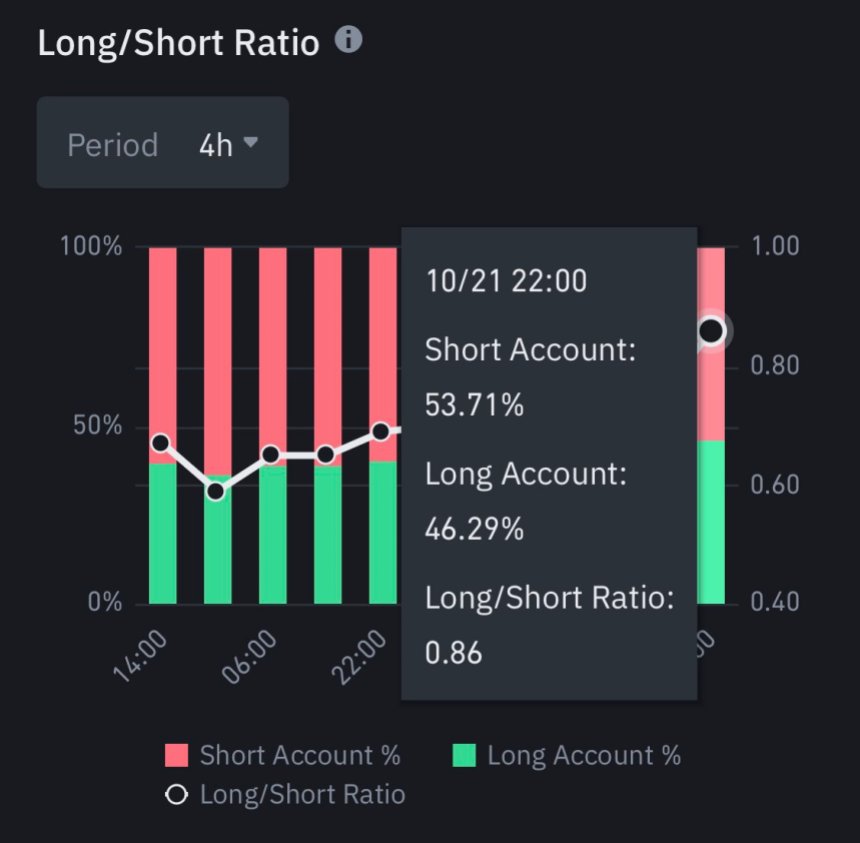

Prime analyst and investor Ali Martinez shared the 4-hour long-short ratio on Binance, revealing that 53.71% of futures merchants are shorting BTC. This bearish positioning suggests indecision available in the market, as merchants stay unsure when Bitcoin will surpass the crucial $69,000 stage. The continued shorting pattern may very well be a short lived barrier to Bitcoin’s momentum.

Nevertheless, the outlook may shift rapidly, as spot traders may make the most of the present dip and begin shopping for Bitcoin. Elevated spot shopping for may present the liquidity wanted to push BTC larger, reversing the bearish sentiment within the futures market.

Associated Studying

If shopping for stress intensifies, Bitcoin may quickly problem and break by means of the $69,000 resistance, probably paving the best way for a brand new all-time excessive. Within the brief time period, traders are intently watching to see whether or not Bitcoin will consolidate additional or acquire sufficient momentum to proceed its upward pattern.

BTC Testing Key Liquidity Ranges

Bitcoin is buying and selling at $66,800 after dealing with a rejection from the $69,000 provide stage. Regardless of the pullback, BTC stays robust, holding above the $66,000 mark. This value stage is crucial, as it is going to possible decide Bitcoin’s route within the coming days.

Ought to BTC fail to carry above $66,000, the worth may search liquidity at decrease ranges, with $64,000 as the subsequent goal. This stage coincides with the 4-hour 200 shifting common (MA) and exponential shifting common (EMA), making it a key curiosity for patrons and sellers.

Alternatively, if Bitcoin maintains its place above $66,000, the subsequent possible transfer might be a renewed problem of the $69,000 resistance or probably a push towards $70,000.

Associated Studying

The approaching days might be essential in deciding whether or not BTC will resume its upward momentum or face additional consolidation round these key ranges. Merchants and traders are intently watching to see how Bitcoin reacts on the $66,000 help, which may set the stage for the subsequent large transfer.

Featured picture from Dall-E, chart from TradingView